Holiday scams have become more challenging to spot than ever, especially with the rise of AI in 2025. Even though the holiday season is the most wonderful time of the year, it is also the time when fraudsters and cybercriminals are most active.

Inboxes are flooded with “flash sales” and “last-minute deals,” and AI is now being exploited to create threats that look startlingly real, from fake delivery texts (smishing) to sophisticated voice-cloning charity fraud. It is getting harder to distinguish a genuine bargain from a trap, and one wrong click can easily turn holiday cheer into a financial disaster.

To help you stay safe, American Consumer Credit Counseling created this guide to break down six essential ways to protect your wallet from holiday scams in 2025.

Key Takeaways:

- Spot the Big Scams: in 2025: Phishing emails, fake online stores, gift card payment scams, charity fraud, AI-generated impersonation scams, and fake delivery or missed packages notices.

- Protect your accounts: Use strong, unique passwords and consider a password manager. Enable two-factor authentication (2FA) for added security. Secure your Wi-Fi network and use a VPN when on public Wi-Fi.

- Verify Before You Buy: If a deal seems too good to be true, it probably is. Verify the retailer’s reputation before you click “Buy.”

- Pay with protection: Always use a credit card instead of using a debit card or wire transfers. Credit cards usually offer stronger fraud protection if you do get scammed.

- Monitor & React: Set up transaction alerts and check your statements weekly. If you spot fraud, report it immediately to your bank and the FTC, and consider placing a fraud alert on your credit report.

6 ways to Protect Your Wallet from Holiday Scams in 2025

1. Recognize the “5 Big” holiday scams in 2025

According to the 2024 FBI Internet Crime Report, there were 193,407 Phishing/Spoofing complaints, resulting in consumers losing a total of $70,013,036. Therefore, knowing what to look for is the best defense against the five big holiday scams in 2025.

Scam Type |

How It Works |

The Red Flag |

|---|---|---|

| Phishing Emails | Emails mimicking retailers (e.g., Amazon, FedEx) with links to steal data. | Sender address has typos (e.g., [email protected]). |

| Fake Online Stores | Fraudulent sites copying real brands to steal credit card info. | Prices are unrealistically low; the site lacks reviews. |

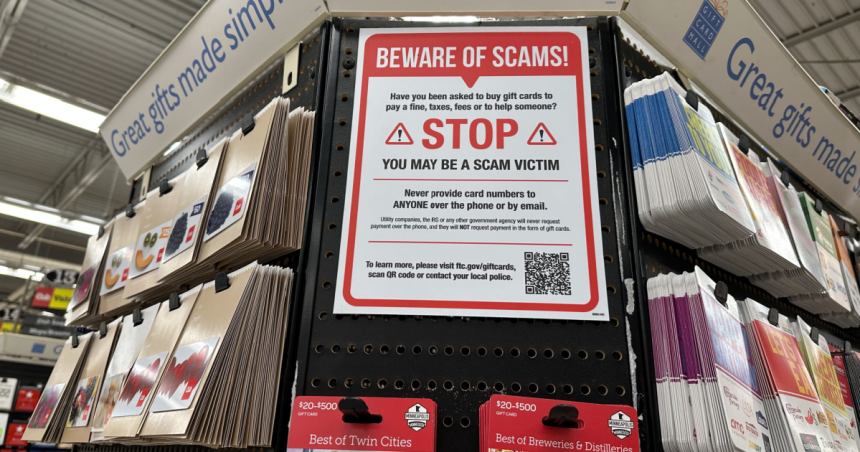

| Gift Card Fraud | Seller demands payment via gift card (Apple, Google Play, etc.). | No legitimate business ever asks for payment via gift card. |

| Charity Scams | Fake organizations are exploiting holiday generosity. | The charity name sounds similar to a real one, but it isn’t on Charity Navigator. |

| Non-Delivery Scams | You buy a product that never arrives, or sell one and never get paid. | Seller refuses to use secure platforms (like PayPal Goods & Services). |

2 . Strengthen your online security

As noted by The New York Times Wirecutter, “While you’re updating your passwords, turn on two-factor authentication for online accounts that support it. Enabling this feature, along with a unique password, makes your online accounts much harder for strangers to access and adds only a few seconds to your routine.”

Here’s how you can strengthen your online security

- Use a password manager: Use a password manager to generate complex and unique passwords for each of your accounts. Never use the same password on two accounts. Use a password manager to securely store them.

- Enable Two-Factor Authentication (2FA): Add it whenever it is available for an extra layer of security. This requires a second form of verification, such as a text message code, in addition to your password.

- Secure Your Wi-Fi Network: Ensure your home Wi-Fi network is password-protected and use a Virtual Private Network (VPN) when accessing public Wi-Fi to encrypt your data.

3. Shop smart, Shop safe

As you hunt for the best deals, keep safety at the forefront:

- Verify Deals and Discounts: If a deal seems too good to be true, it probably is. Compare prices and check the retailer’s reputation before making a purchase.

- Use credit over debit: Credit cards offer stronger fraud protection and easier dispute resolution than debit cards. Many credit cards also offer zero liability for unauthorized purchases.

- Avoid Public Wi-Fi for Transactions: Avoid shopping on public Wi-Fi networks without a VPN. If you must shop, use mobile data to make purchases rather than public Wi-Fi.

4. Monitor your financial accounts regularly

Don’t wait until your monthly statements to check unauthorized transactions. Make it a habit to keep track of your accounts on a regular basis.

- Review pending charges on accounts – Scammers often test a card with small charges (under $5) before making a large purchase. Report these immediately.

- Set Up Alerts: Most banks and credit card companies offer alerts for large transactions or unusual spending patterns. Enable these alerts to stay informed of activity on your accounts.

5. Educate yourself and loved ones

Scammers often target vulnerable demographics because they are easier to reach and less tech-savvy.

- Stay Informed: Keep up to date with the latest scams by following consumer protection websites and news outlets.

- Teach Family Members: Discuss common scams and safety measures with family, especially those who may be more vulnerable, such as elderly relatives or young adults new to managing their finances.

- For example, teach young adults and students how to identify a secure checkout URL (https:// and the padlock icon). Warn elderly relatives about AI voice scams that may sound like a grandchild in distress.

- Use Trusted Resources: Instead of relying on social media for financial advice, encourage family members to explore nonprofit organizations such as American Consumer Credit Counseling for verified guides on safe spending and credit management.

6. Action Plan: What should I do if I fall for a scam?

Here’s what to do if you have been targeted.

- Report the Scam: Contact your bank or credit card company immediately to report unauthorized transactions. They can help you secure your accounts and potentially recover lost funds.

- File a federal Complaint: Report the scam to the Federal Trade Commission (FTC). This helps authorities track scams and prevent others from falling victim to them.

- Monitor Your Credit: Consider placing a fraud alert on your credit report and regularly reviewing it for unusual activity. This can help prevent identity theft.

- Assess the Financial Damage: If a scam has drained your checking account or maxed out your credit card, don’t panic. Reach out to a nonprofit like ACCC for a [to help prioritize your remaining bills and avoid falling into a debt cycle while the bank investigates.

Secure Your Finances in 2025

Protecting your wallet this holiday season requires more than hope; it requires action. By treating every unsolicited message with skepticism and locking down your accounts with 2FA and strong passwords, you can stop scammers before they strike.

Remember: If a deal looks too good to be true, it is. Don’t let the pressure of “last-minute 2025 deals” cloud your judgment.

Need Help Managing Holiday Debt? If you are feeling overwhelmed by holiday expenses or are recovering from a financial setback, you don’t have to navigate it alone. American Consumer Credit Counseling (ACCC) is here to help you regain control.

Frequently Asked Questions

Q: What are the most common holiday scams I should be aware of?

A: The most common holiday scams in 2025 include AI-generated phishing emails, fake delivery texts (smishing), and QR code fraud (quishing). 2025 has seen a rise in “quishing”—where scammers paste fake QR codes over real ones on parking meters or mailers to steal payment data. Be wary of any text message claiming a “delivery delay” that asks you to click a link.

Q: Is it safe to buy items directly from social media ads?

A: It is risky; scammers often use AI to create fake storefronts on social platforms that vanish after collecting payments. Instead of clicking “Buy Now” on Instagram or TikTok, open a new browser tab and search for the retailer directly. If the store doesn’t exist outside of social media, or if the prices are 80-90% off, it is likely a scam.

Q: What should I do if I suspect I’ve fallen for a scam?

A: If you suspect you’ve fallen for a scam, immediately report it to your bank or credit card company, file a complaint with the Federal Trade Commission (FTC), and monitor your credit and bank statements for any unusual activity.

Q: What’s the safest way to pay for holiday shopping online?

A: Credit cards are the safest option because they offer federally mandated fraud protection (Zero Liability). Avoid using debit cards and wire transfers. Also, try to avoid making direct peer-to-peer payments (like Zelle or Cash App) for retail purchases. If you are scammed using these methods, it is nearly impossible to get your money back.

Q: How can you tell if an online retailer or charity is fake?

A: Check their URL for inconsistencies such as misspellings. (Ex: Amaz0n.com) For charities, research them thoroughly on sites like Charity Navigator or GuideStar to ensure they are legitimate before donating.

Q: How can I strengthen my online security during the holiday season?

A: Strengthen your online security by using strong and unique passwords for each account, enabling two-factor authentication whenever possible, securing your Wi-Fi network, and using a VPN when accessing public Wi-Fi.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.

Read the full article here