THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

When I first started to take initiative and improve my finances, the first step was to build a solid savings base.

I knew that by having a large pile of savings, I would cover myself if emergencies happened.

And having this savings would also allow me to focus on investing my money and growing it faster.

Thanks to my finance background, I understood the power of compound interest and wanted to find a savings account that offered me a high yield.

This is because the higher the interest rate, the more interest I would earn.

Today, many online banks try to be the one stop shop for all your banking needs.

As a result, they don’t offer competitive interest rates, thus taking longer to grow your savings.

Luckily, CIT Bank is here.

They offer one of the highest yields in the country so your savings will grow as fast as possible.

In this post, I am going to show you why I keep my savings with CIT Bank and why you should too.

CIT Bank Review | The Best Place To Grow Your Savings

What Is CIT Bank?

Founded more than 100 years ago, CIT Bank began as a brick and mortar bank specializing in helping businesses and individuals with their money.

Today, CIT Bank is primarily an internet bank, but it does have a few physical branches in California under the OneWest Bank division.

As a banking institution in the US, it is regulated by the Office of the Comptroller of the Currency.

CIT Bank Products

CIT Bank offers a variety of products and services that helps you in meeting your financial goals and improving your finances.

These products include:

- eChecking

- Money markets

- Savings builder

- Jumbo CD

- Term CD

- No-penalty CD

Here is a detailed look at each one.

eChecking

Recently, CIT Bank introduced a checking account to customers. This makes CIT a one stop banking solution.

The checking account follows the same premise as other accounts, meaning no fees and a competitive interest rate.

They also offer up to $15 in ATM reimbursement fees a month and work with many digital payment solutions including Zell, Bill Pay, Apple Pay, and Samsung Pay.

Money Market Accounts

A CIT Bank money market account is particularly advantageous for customers who can maintain a $25,000 balance.

At that level, you’ll unlock their highest earning potential, often surpassing what many traditional banks offer on similar accounts.

Savings Builder

CIT Bank’s Savings Builder account is designed for consistent savers. It offers many of the same advantages as the money market account—without requiring a large minimum balance.

Check out the short video below to learn more about how it works.

Start with a $100 opening deposit, then continue adding $100 or more each month to keep earning their top rate.

If you miss a monthly deposit, your rate will dip temporarily, but it’ll bounce back as soon as you resume your regular savings habit.

Best Bank Account

CIT Bank

With some of the highest paying interest rates in the U.S. CIT Bank stands out as offering the best savings accounts, specifically the Savings Connect Account. Add in ease of use and great customer service, and you have a clear winner.

LEARN MORE

CIT Bank Personal Account Disclosures

For complete list of account details and fees, see CIT Bank Personal Account disclosures.

Jumbo CD

CIT Bank has some of the best CD options available.

The jumbo CD will maximize your return on investment without any stress on your part.

Terms range from 2 to 5 years and have various rates.

There are no account opening fees, interest is compounded daily, and your CD is FDIC insured.

Term CD

With an opening deposit of $1,000 you can open a high-yield CD for terms ranging from 6 months to 5 years, and rates with various rates as well.

There is no fee to open an account, your interest compounds daily, and your CD is FDIC insured.

No-penalty CD

Open a no-penalty, 11-month CD with only $1,000 and have access to your funds without fear of penalties if you need to make an early withdrawal.

Interest is compounded daily and funds are insured by the FDIC.

Opening An Account With CIT Bank

Opening an account with CIT Bank is simple and can be done in less than 10 minutes.

In fact, there are just 3 simple steps to opening an account, regardless of the bank product you want.

That is all there is to it.

Of course, if you are opening a Savings Builder account, I recommend you set up a monthly transfer of $100 so you guarantee yourself the highest yield possible.

Best Bank Account

CIT Bank

With some of the highest paying interest rates in the U.S. CIT Bank stands out as offering the best savings accounts, specifically the Savings Connect Account. Add in ease of use and great customer service, and you have a clear winner.

LEARN MORE

CIT Bank Personal Account Disclosures

For complete list of account details and fees, see CIT Bank Personal Account disclosures.

CIT Bank Fees

This is another area where CIT Bank shines.

They don’t charge any of the typical fees most banks charge.

For instance, you won’t see any of these fees:

- No account opening fees

- No monthly maintenance fees

- No inactivity fees

- No account closure fees

And with a minimum deposit of $25,000, there no wire transfer fees either.

But if your balance drops below this, there may be a fee for outgoing wire transfers.

Note the fee is only on outgoing wire transfers. There are no fees for incoming wire transfers.

For Savings Builder accounts, instead of charging a fee, you earn a lower interest rate if your balance falls below the minimum amount or you don’t make the required monthly deposit.

However, once your balance is higher than the minimum or you complete the required monthly deposit, you earn the highest interest rate again.

Advantages And Drawbacks

Advantages

Here is a quick summary of the things that makes CIT Bank stand out from other banks.

- Competitive interest potential

- No monthly maintenance or service fees

- Low opening deposit requirement

Drawbacks

There are a few wish-list items I would like to see improved upon or implemented with CIT Bank.

- No physical branches / online-only model

- Tiered / conditional qualification for best rates

- Slower transfers / fund access wait times

Frequently Asked Questions

Here are the most common questions I get asked about CIT Bank.

This is a great place to focus on if you are short on time.

Is CIT Bank legit?

Yes, CIT Bank is a legitimate bank.

CIT Bank has been in business for over 100 years and is regulated by the United States Treasury.

In addition to offering online banking to customers, they have roughly 60 physical branches in California under the name OneWest Bank.

Finally, FinTech Breakthrough rated CIT Bank the best personal financial company for 2019.

Is CIT Bank secure?

CIT Bank does everything it can to keep itself and customers data secure.

For starters, they use state of the art 188-bit SSL encryption to have a secure browser.

In addition, they automatically sign you out of your account after a period of inactivity as well as layered security so only you can access your account information.

For a complete run down of the security measures CIT Bank takes to keep secure, see below.

Who is CIT Bank owned by?

CIT Bank is owned by CIT Group.

CIT Group offers banking services through CIT Bank and also offers financing, leasing, and other services to small business in the United States.

Is CIT Bank and Citibank the same?

No.

They are two completely different companies.

Many people falsely believe they are the same since the parent companies sound the same.

CIT Bank is owned by CIT Group and Citibank is owned by Citigroup.

Does CIT Bank offer a high interest rate?

CIT Bank consistently offers some of the highest interest rates on all of the products they offer.

And they don’t make you jump through hoops to earn this premier interest rate.

Just deposit a certain amount or set up a monthly deposit of $100 and you are set.

How long does it take to transfer money to CIT Bank?

Transfers to and from CIT Bank take on average 3-5 business days to complete.

This is typical for the banking industry, though some now offer faster transfer times.

What products does CIT Bank offer?

CIT Bank offers a handful of high interest bank products for consumers.

These include:

- Savings Builder

- Money Market Accounts

- Certificates of Deposit

- Premier High Yield Savings

The interest rates on these products varies. To get the most current rates, click here.

Is my money with CIT Bank safe?

The money you deposit with CIT Bank is covered by FDIC Insurance.

This insurance protects up to $250,000 worth of deposits.

This means that if CIT Bank goes bankrupt or out of business, you will get your money back.

What fees does CIT Bank charge?

CIT Bank charges very little fees.

In fact, the fees are only related to certain activities and not on the accounts themselves.

With CIT Bank, you are not charged any account opening fees or monthly service fees.

The few fees they do charge are on outgoing wire fees and overdraft fees on their money market account.

Is CIT Bank Good?

Yes, CIT Bank is a solid choice for savers who want competitive interest rates and low fees.

It’s an online-only bank, so it’s best suited for people comfortable managing their money digitally.

While transfers can take a bit longer than at some banks, CIT offers strong value overall for those focused on growing their savings.

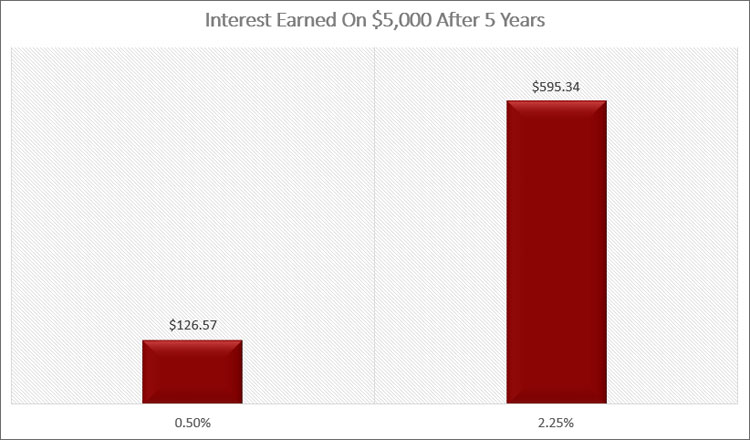

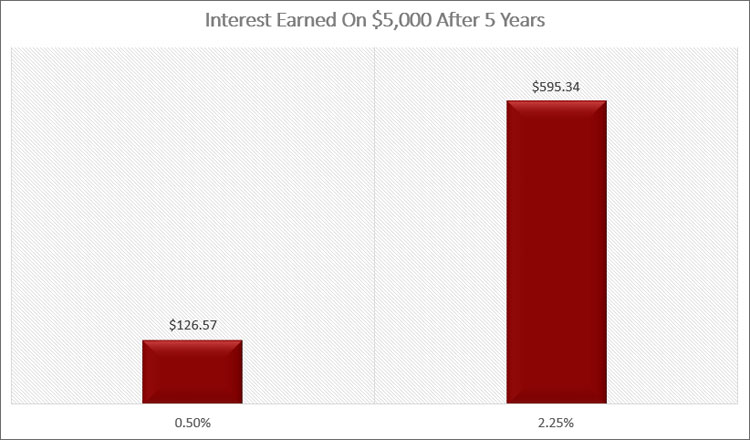

Why does a high interest rate matter?

The higher the interest rate on your savings, the faster your money compounds and grows.

Here is a simple example for you.

Let’s say you have $5,000 and can put it into a savings account that earns 0.50% interest or one that earns 2.25% interest.

Here is how much interest you earn in 5 years in each account.

As you can see, the higher interest paying account grows your money faster.

This is why you want to make sure when you open your savings account with CIT Bank, you set up a monthly transfer of $100 so you earn the highest interest rate they offer.

Best Bank Account

CIT Bank

With some of the highest paying interest rates in the U.S. CIT Bank stands out as offering the best savings accounts, specifically the Savings Connect Account. Add in ease of use and great customer service, and you have a clear winner.

LEARN MORE

CIT Bank Personal Account Disclosures

For complete list of account details and fees, see CIT Bank Personal Account disclosures.

CIT Bank Alternatives

There are a lot of online banks out there, but not all are created equal.

Here are two alternates to CIT Bank that compete well.

CIT Bank vs. Ally

What makes Ally stand out vs. CIT Bank is they offer checking accounts. Because of this, they could be you only bank you use.

In addition to this, they pay competitive interest rates on their savings products. However, their rate is not as high as CIT Bank.

You can click here to learn more about Ally Bank.

CIT Bank vs. Capital One 360

Capital One 360 also offers a complete banking experience like Ally Bank does.

The difference with Capital One 360 is the interest they pay on their savings accounts is considerably lower than CIT Bank and Ally Bank.

Still, they are easy to use and many customers are happy with them.

CIT Bank vs. Betterment Everyday

Betterment offers a checking and savings product as well, called Betterment Everyday.

The main difference between these accounts and CIT Bank is Betterment is not a bank. It partners with banks to offer you a banking product.

Betterment does not charge any fees on their checking or savings accounts and both earn interest.

And like CIT Bank, Betterment Everyday offers FDIC insurance on your money.

Final Thoughts

At the end of the day, CIT Bank offers savings products to help you save money. And it does an amazing job at this.

It doesn’t have any frills or bells and whistles, which allows them to offer one of the highest interest rates in the country.

While some people might see the lack of extras as a drawback, I see it as a strength.

Your savings is there to grow and to be used for specific goals. By not having the extras, your money grows faster and stays in your account to grow.

And when I was first starting to work on building wealth, this is what I wanted.

So I opened up an online bank account and I shredded the ATM card. I didn’t want easy access to the money.

I wanted it to grow and compound.

And that is what it did.

If you want to start improving your finances you need to build a savings cushion and CIT Bank helps you do this efficiently and effectively.

Read the full article here