Benjamin Graham once wrote, “The true investor…will do better if he forgets about the stock market and pays attention to his dividend returns and to the operation results of his companies.”

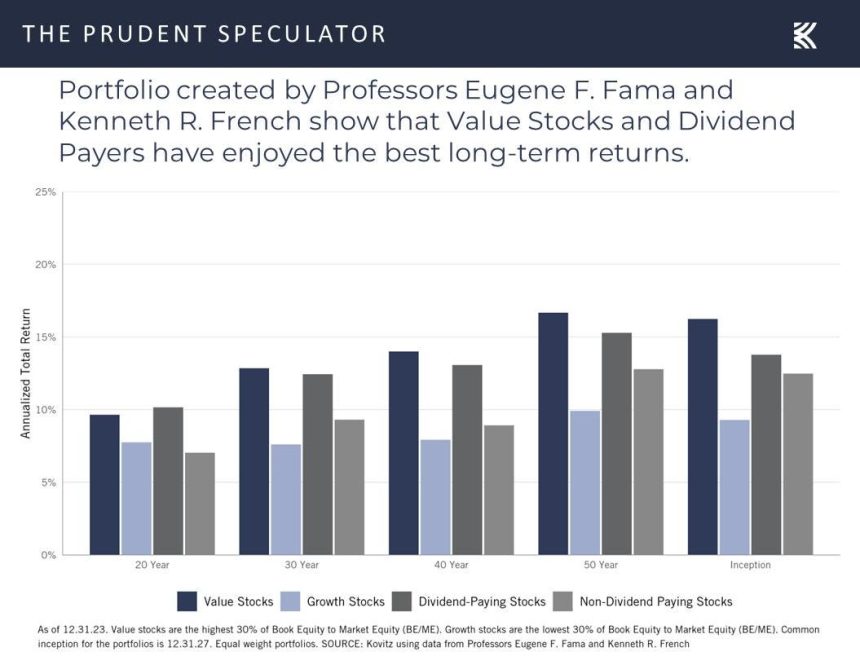

Happily, history validates the legendary investor’s assertion! In addition to receiving a handsome income stream, those who own Dividend Paying stocks also have received significant capital appreciation through the years.

I recently produced a Webinar on the merits of dividend stocks and offered 7 stocks picks. Click below to learn more about accessing the Webinar and read on for two of those selections!

Income Stocks & Retirement Planning : Webinar Q&A Follow-Up (theprudentspeculator.com)

2 UNDERVALUED HIGHER YIELDING STOCKS

CVS Health (CVS) is one of the largest domestic retail pharmacy networks, is a leading pharmacy benefits manager (PBM) and serves millions of people through traditional health insurance (via Aetna). These businesses under one roof offer diversification and form a three-legged stool which stands to improve the cost of healthcare delivery.

Shares struggled during 2023, falling more than 15%, however the negativity turned a bit coming out of the company’s Investor Day in December, where management reset expectations for earnings growth over the intermediate term. Looking at 2024, CVS in February said it expects to earn at least $8.30 per share on operating cash flow of at least $12.0 billion. CVS also laid out plans targeted at simplifying the pricing system for how its pharmacies are reimbursed for non-specialty pharmaceuticals by PBMs.

While improvements to financial results from these developments are unlikely to be immediate, I think they should be welcomed by customers. I continue to be constructive on the acquisitions of and continued investment in both Oak Street and Signify, and note the company continues to focus on healthcare delivery, expecting revenue in the space to grow to $10 billion in 2024 and by mid-double digits through 2028. Demographic trends (an aging population) serve as a tailwind for long-term growth. Shares trade for less than 10 times forward EPS projections and offer a 10% free-cash-flow yield. The dividend yield (the payout was recently hiked by 10%) is 3.5%.

DHL Group (DHLGY) is a centuries-old parcel-carrier that delivers to customers in 220+ countries and is positioned to benefit from easing financial conditions and a more consumer-friendly energy backdrop following regional crises. E-commerce trends remain a significant long-term growth driver.

The recent sale of stock by Germany’s state-owned development bank (DHL’s largest shareholder) has weighed on shares in recent weeks, while the German giant reported Q4 results that included a disappointing 2024 outlook. Management said the company is experiencing a soft macroeconomic environment including a lack of a tailwind in the first half of 2024 and subdued B2B (business to business) volume growth.

I think the stock offers geographic diversification to U.S. centric portfolios, while the company’s just-hiked dividend affords a net yield of 4.1% and the company just added €1 billion to the share buyback program, bringing the total value of the plan to €4 billion since inception. DHLGY provides a solid income stream for shareholders and earnings should return to growth after a trough year in 2023, The shares also look inexpensive relative to U.S. peers on a P/E and FCF yield basis.

Read the full article here