Photography by Getty Images

Key takeaways

- Data breaches, financial fraud and internet crime have increased in recent years, so now’s the time to review how to protect your finances.

- If you haven’t already frozen your credit to prevent financial fraud, now may be the time to do it.

- Freezing your credit is free and has no impact on your credit score.

Falling victim to a scam can be debilitating for your personal finances, and worryingly, financial fraud is becoming more common. Bankrate’s recent Financial Fraud Survey found that 1 out of 3 U.S. adults fell victim to financial fraud or a scam in 2024.

Cybercrime is increasing, so how can you protect your data and your finances? Other than keeping your passwords safe and ignoring scam texts, one of the best ways to protect yourself from identity theft and fraudulent accounts is to freeze your credit.

When you freeze your credit, you prevent any creditors from accessing your credit report, which will stop them from approving new accounts in your name — whether legitimate or fraudulent.

Should you freeze your credit?

The Federal Bureau of Investigation Internet Crime Complaint Center’s (FBI IC3) most recent Internet Crime Report shows that it received almost 300 million phishing reports in 2023. And cybersecurity company Crowdstrike reports that vishing (voice phishing) scams were up 442 percent between the first and second half of 2024. So, is freezing your credit worth it? It is, says Monique White, accredited financial counselor and Self Financial’s head of community.

“We are susceptible to hacks nowadays,” says White. “We’re getting notices about security breaches happening [frequently].”

If the increase in internet crime isn’t enough to convince you, here are some other good reasons you might freeze your credit:

- Your data was compromised in a breach

- You fell victim to a scam that exposed your personal data

- You found a fraudulent account on your credit reports

- To prevent criminals from opening accounts in your name

- To prevent friends or family from opening accounts in your name

- Peace of mind

“If you do not plan on taking out any loans or trying to get a line of credit, there’s no harm in putting a security freeze on your credit report, just to protect your information a little bit better,” White says. “So it’s just an extra layer of security and peace of mind.”

So why wouldn’t you freeze your credit? Freezing your credit doesn’t have any impact on your score but if you’re at the beginning of your credit-building journey, it might be better not to freeze your credit.

“I don’t necessarily think it should be pushed at the beginning of someone’s credit-building experience,” White warns. “It’s time-consuming, and we really just want people to focus on establishing healthy financial habits of making on-time payments and keeping credit card balances low.”

Once you feel comfortable with your credit score and don’t have plans to apply for loans or other credit products in the near future, you can freeze your credit for protection and peace of mind.

How to freeze your credit

Freezing your credit is easy after you create accounts with Equifax, TransUnion and Experian. If you want to place a freeze, here’s what to do.

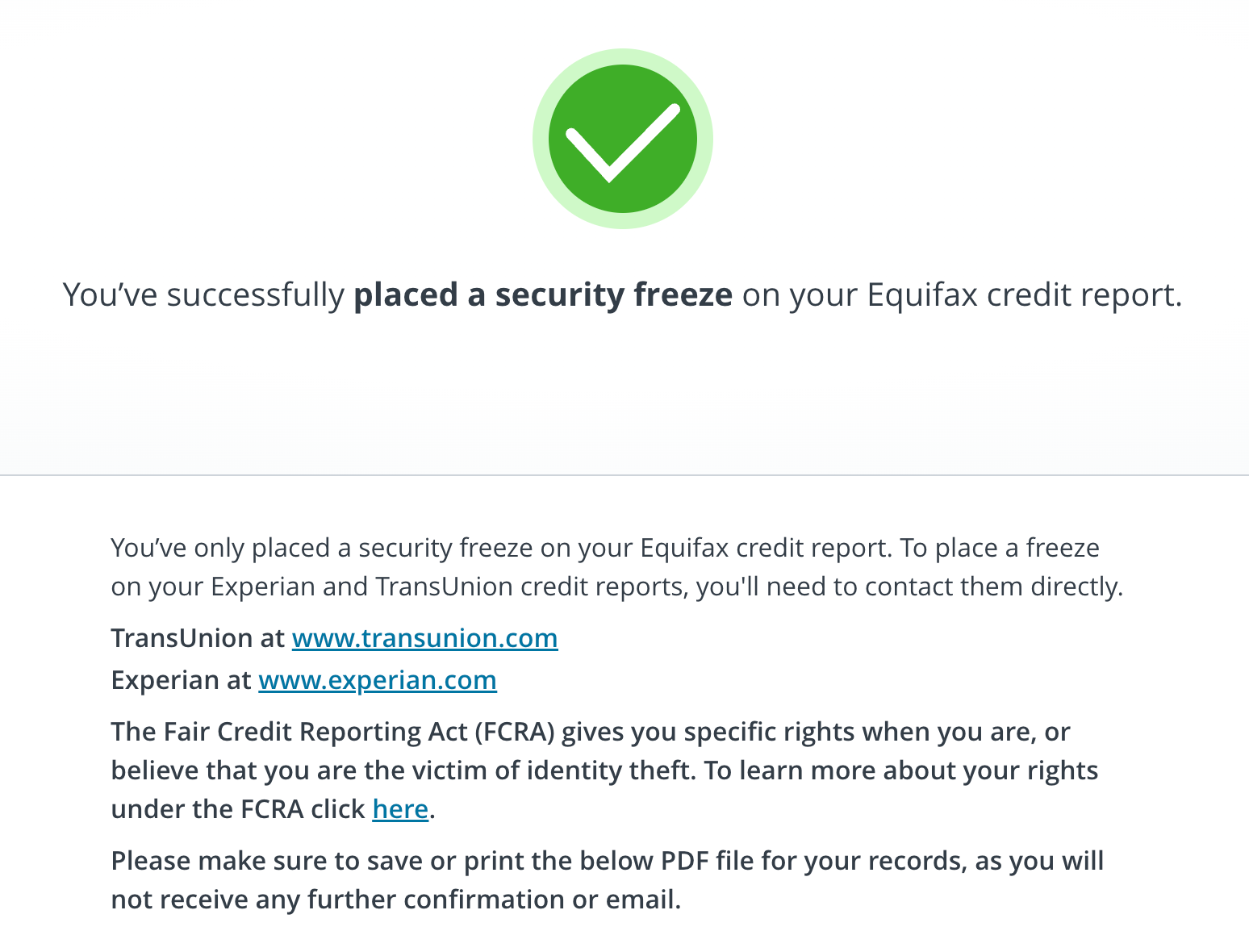

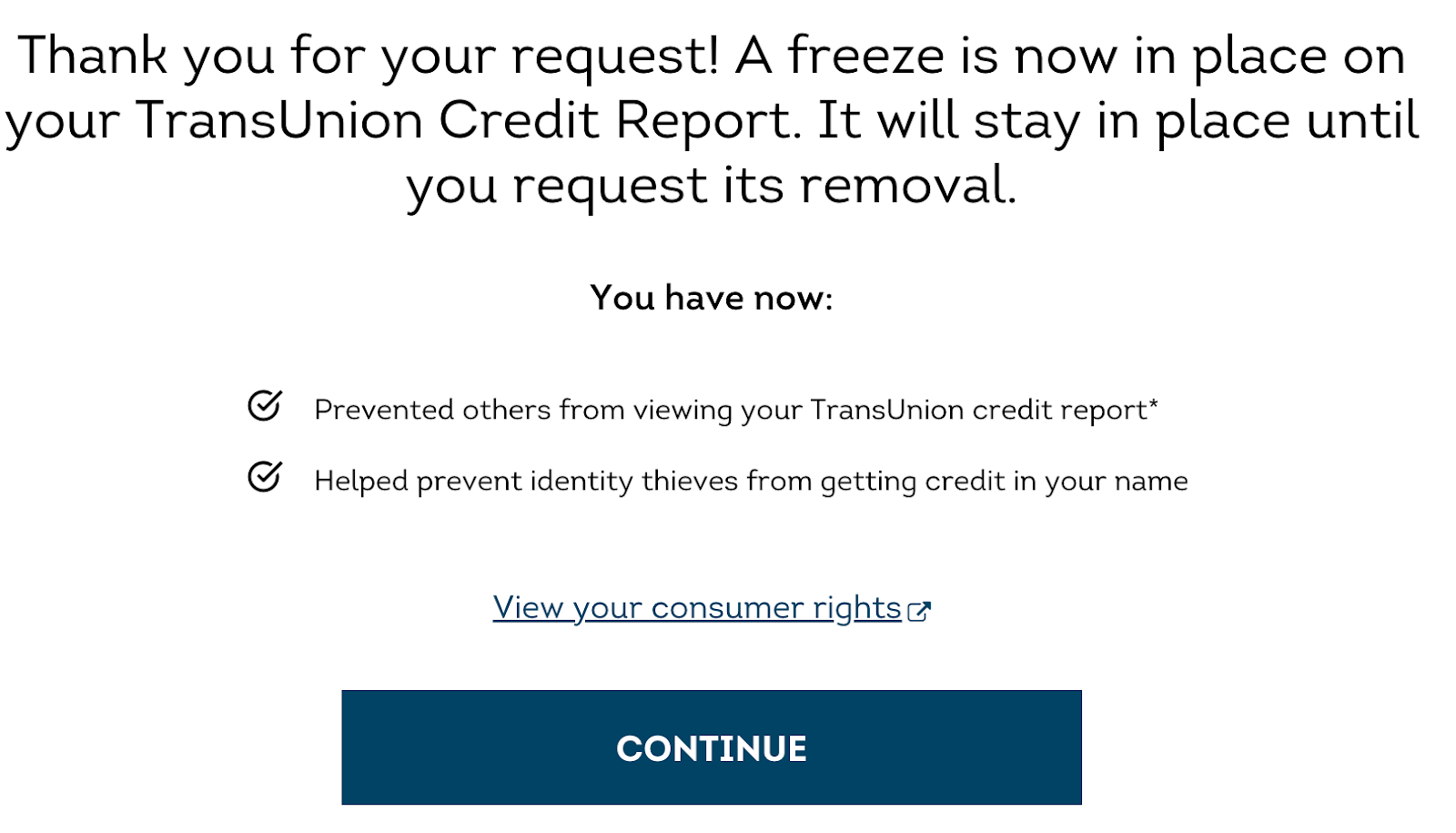

Freezing your credit with Equifax and TransUnion

Freezing your credit profile with the three credit bureaus takes just a few moments after creating and verifying your accounts with each. Here are the general steps to placing a credit freeze with Equifax and TransUnion bureaus:

- Log into or create your account with the bureau.

- On your account’s homepage, click “Place a freeze” in one of the tiles.

- Follow the prompts and click “Place a freeze” on the final prompt.

- Your credit report is now frozen.

EXPAND

EXPAND

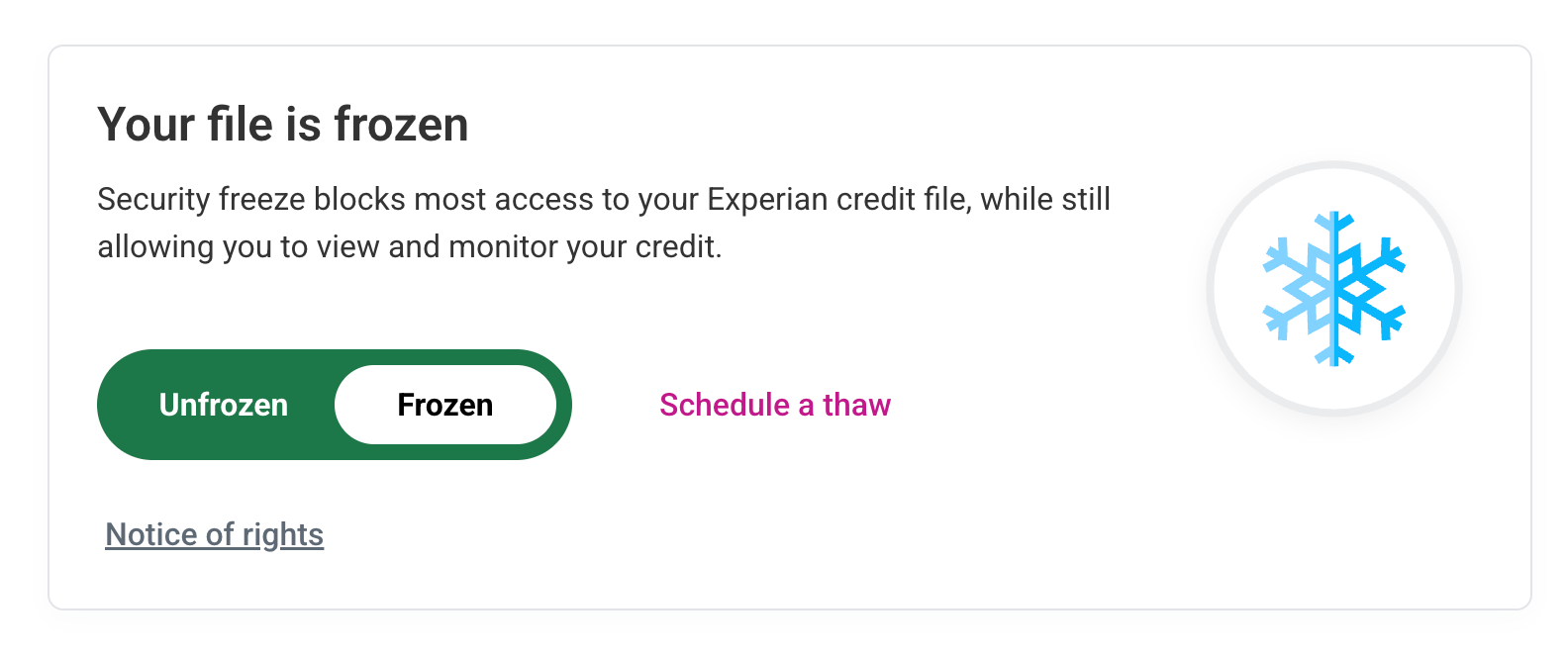

Freezing your credit with Experian

Placing a credit freeze on an Experian profile is a little different, but still quick and easy.

- Log into or create your Experian account.

- From the homepage, scroll to the bottom of the page and click “Security freeze” under “Tools.”

- Once on the security freeze page, toggle the slider to “Frozen” and your credit file will freeze.

EXPAND

What if you need to unfreeze your credit?

Because creditors can’t pull your credit to determine approval, you may have an extra step to complete in opening your credit before submitting applications for loans, credit cards and other products.

“It’s just something to consider — not a downside — but you do have to plan accordingly,” White says.

If you need to unfreeze your credit completely, you can log into your credit bureau accounts and simply click a button to unfreeze your file.

You can also thaw your credit, which means temporarily lifting the freeze for a set period, so potential creditors can access your profile and determine your eligibility for approval. At the end of the thaw, your credit will automatically freeze again on the date you specify and your information can’t be accessed.

The bottom line

With a dizzying increase in cybercrime and data breaches, now may be the best time to freeze your credit to better protect your data and prevent financial fraud — if you haven’t already. Even if you plan to apply for credit soon, you can thaw your credit for a predetermined period and your credit will freeze again. Freezing your credit is free and doesn’t affect your credit score, so there’s virtually no downside to this extra layer of protection for your data.

Read the full article here