Image courtesy of Daphne Subar; Illustration by Bankrate

Key takeaways

- Involuntary collections resumed May 5, 2025 for borrowers who have defaulted on their federal student loans.

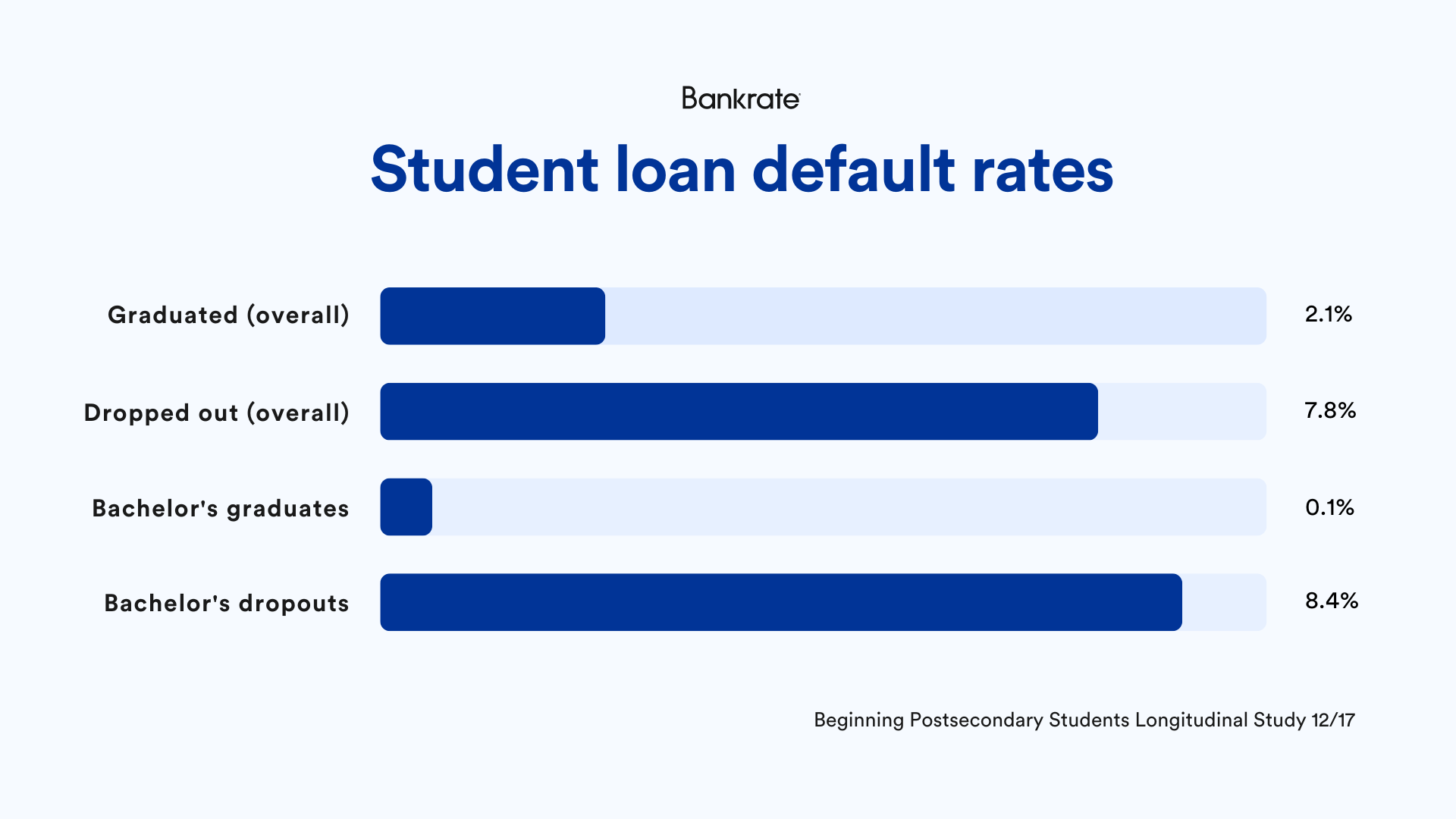

- College dropouts are nearly four times more likely to default than those who graduate.

- Among students who started Bachelor’s degree programs, college dropouts are 95 times more likely to default and represent nearly all of the defaults within this group.

- By comparison, borrowers whose student loan debt is in sync with their income are significantly less likely to face default.

Policymakers often blame student loan delinquencies and defaults on the amount of debt. But I argue there really isn’t a student loan problem, so much as a college completion problem.

On May 5, 2025, the federal government resumed involuntary collections on defaulted federal student loans. Millions of borrowers face these actions, underscoring the importance of understanding this problem’s true drivers. Are student loan defaults caused by students graduating with too much debt, or are they caused by a failure to graduate?

The looming impact of collections

On May 5, 2025, the U.S. Department of Education restarted enforced collection of defaulted federal student loans.

The federal government has strong powers to compel repayment of defaulted federal student loans, aside from ruining the borrower’s credit history, including:

- Wage garnishment: Administrative Wage Garnishment (AWG) allows the U.S. Department of Education to garnish up to 15 percent of the borrower’s disposable income, without a court order.

- Offset income tax refunds: The federal government can seize federal and state income tax refunds and state lottery winnings through the Treasury Offset Program (TOP).

- Offset Social Security benefits: The federal government can offset up to 15 percent of Social Security disability and retirement benefit payments.

- Bank levy: If the federal government sues the borrower and receives a court judgment, they can seize the money in the borrower’s bank accounts through a bank levy.

- Professional licenses: The federal government can prevent renewal of professional licenses for defaulted borrowers.

- Driver’s licenses: The federal government can prevent renewal of driver’s licenses in three states: Montana, Iowa and Oklahoma.

The Federal Reserve Bank of New York estimates that as many as 9 million delinquent student loan borrowers will experience big decreases in their credit scores soon, reversing the gains made during pandemic-era financial relief.

Education Department announces May start date for federal student loan collections

A new report from FICO showed that the first wave of student loan delinquencies dropped the national average FICO score one point — from 716 in January to 715 in February. Collections actions from the federal government will soon worsen credit scores for millions of delinquent and defaulted borrowers.

Read more

Challenging the narrative of excessive graduate debt

Despite U.S. Education Secretary Linda McMahon’s assertion that colleges are “piling up multibillion-dollar endowments while students graduate six figures in the red,” the reality is more nuanced.

While six-figure student loan debt exists, it is often associated with graduates who also earn substantial incomes, enabling them to manage their repayments. Data from the 2019-2020 National Postsecondary Student Aid Study (NPSAS) reveals that only a small fraction of Bachelor’s and graduate degree recipients leave college with six-figure debt — 0.9 percent and 10.7 percent, respectively. The average student loan debt is closer to $38,000 per borrower.

This higher percentage among graduate students is largely driven by professional programs like medicine, pharmacy, veterinary medicine and dentistry. More than 50 percent of these graduates leave school with six-figure debt (almost seven-in-eight for dentistry). However, high earning potential often justifies the significant investment. In contrast, only a small percentage of Ph.D. (3.9 percent) and MBA (3.2 percent) students face such high debt burdens.

The real burden: Student loan debt without a degree

The more significant issue lies not with graduates carrying high debt who also possess the earning power to repay, but with those who accumulate debt without completing their degree.

Money tip:

Research consistently demonstrates that students whose debt at graduation is less than their annual income generally manage repayment within ten years.

However, those with debt exceeding their income may require alternative repayment plans, such as extended repayment or income-driven repayment, to afford the monthly payments.

These borrowers are more likely to postpone major life events such as buying a home (30 percent more likely), getting married (30 percent more likely) and having children (30 percent more likely). They are also less likely to pursue further education (25 percent less likely) and more prone to taking jobs outside their field or working multiple jobs (40 percent more likely). While default rates do correlate with increasing total student loan debt, they inversely correlate with income and a healthy debt-to-income ratio.

So, keeping student loan debt in sync with income is critical — but those who dropped out of college may struggle to do so.

The stark reality of dropout default rates

The data unequivocally demonstrates that college dropouts are disproportionately at risk of default.

Among all undergraduate students, those who leave college without a degree are nearly four times more likely to default on their student loans (7.8 percent) compared to graduates (2.1 percent), as evidenced by an analysis of the Beginning Postsecondary Students Longitudinal Study. This translates to non-completers representing a staggering 72 percent of all student loan defaults.

EXPAND

The disparity is even more pronounced among students initially enrolled in Bachelor’s degree programs, where those who dropped out are an astonishing 95 times more likely to default (8.4 percent) than graduates (0.1 percent), accounting for 97 percent of the defaults within this group.

The fundamental problem is clear: College dropouts have the debt but not the degree that can help them repay the debt.

— Mark Kranowitz

Bankrate Expert Contributor, Student Loans

Numerous other studies, including those from the Federal Reserve Bank of New York and the Pew Research Center, corroborate these findings, consistently showing that college dropouts face a substantially higher risk of student loan default than their graduating peers.

Bottom line

A genuine solution to the student loan challenges demands that policymakers and institutions move beyond solely focusing on the amount of student loan debt. They must actively prioritize college completion.

Strategic investments in initiatives that support students through graduation are crucial, not only for equipping them with the credentials needed for financial success, but also for reducing the student loan default crisis.

Read the full article here