The most important thing to know about changes to federal student loan repayment plans is that while they won’t arrive overnight, they will be thunderous.

Passed in July as part of the One Big Beautiful Bill Act, these provisions will have the most significant impact on students and families borrowing federal loans on or after July 1, 2026.

Fortunately, if you’re already in repayment on government-held education debt, you get a three-year on-ramp into the new repayment plan options. Takeaway: You can keep your current federal loan repayment plan until at least July 1, 2028.

| Plans available to borrowers already in repayment | Plans for new loans borrowed before July 2026 | Plans for new loans borrowed after July 2026 |

|---|---|---|

| Standard Graduated Extended Income-Based (IBR) Income-Contingent (ICR) Pay As You Earn (PAYE) Saving on a Valuable Education (SAVE, not accepting new borrowers) |

Standard (modified) Repayment Assistance Plan (RAP) IBR |

Standard (modified) RAP |

With that said, the new RAP and standard plans differ from your current options and there’s a lot of fine print. Let’s start sifting.

1. Current borrowers have nearly three years to switch plans

Before the legislation passed both chambers of Congress, the Senate Parliamentarian ruled that limiting current borrowers’ options to the new Standard Repayment Plan and RAP fell outside the budget reconciliation process and would be subject to a 60-member vote in the Senate. As a result, current borrowers will also have the option of IBR — and won’t have to worry about switching from an expiring plan until mid-2028.

What about SAVE Plan borrowers?

The Big Beautiful Bill repeals SAVE and requires the Education Department to move its borrowers to another repayment plan by 2028, but that doesn’t mean these SAVE enrollees will continue to enjoy an interest-free forbearance. In fact, the Department announced on July 9 that interest charges will resume for SAVE borrowers in August.

2. You could lose access to older plans by consolidating

As former Federal Student Aid director Colleen Campbell wrote for her Substack, On Detail, there’s one serious pitfall for borrowers who’d prefer to hang onto their expiring plans or IBR. If you take out a federal Direct Consolidation Loan on or after July 1, 2026 (to consolidate multiple federal loans with the Education Department), you’ll be limited to the new standard and RAP options.

3. Unfortunately, Parent PLUS Loan borrowers aren’t eligible for RAP

If you’re a mom or dad who borrowed on behalf of your child, your repayment plan menu will soon be even shorter.

| Parent PLUS Loan borrowers currently on ICR | Parent PLUS Loan borrowers NOT currently on ICR |

| You’ll transition to IBR | You’ll be limited to the new Standard plan |

Student loan lawyer Stanley Tate says he has been advising his clients on a workaround: Consolidate into the ICR plan before July 2026 to build in future flexibility.

4. There’s a higher minimum monthly payment on RAP

If you’ve already utilized income-driven repayment plans, you might know that your monthly payment could be as low as $0. After all, it’s derived as a percentage of your discretionary income, and if your income falls precipitously, so too does your payment obligation.

But under RAP’s adjusted gross income (AGI) formula, you’d always owe at least $10 per month or $120 per year.

| Adjusted gross income (AGI) | Monthly payment |

|---|---|

| Up to $10,000 | $10 |

| $10,001 to $20,000 | 1% of AGI |

| $20,001 to | 2% of AGI |

| $30,001 to | 3% of AGI |

| $40,001 to | 4% of AGI |

| $50,001 to | 5% of AGI |

| $60,001 to | 6% of AGI |

| $70,001 to | 7% of AGI |

| $80,001 to | 8% of AGI |

| $90,001 to | 9% of AGI |

| $100,001 and up | 10% of AGI |

What’s my AGI?

You can find your adjusted gross income on your tax return — look for line 11 on your Form 1040. Your AGI is calculated by adding all of your sources of income and then subtracting certain above-the-line tax deductions, including student loan interest, educator expenses and IRA and HSA contributions.

5. Given the switch to AGI, your RAP payment could become less affordable over time

Student loan lawyer Stanley Tate is among experts who fault RAP for not accounting for the increasing cost of living. Under IBR, for example, your monthly payment equates to 15 percent of your discretionary income — defined by the Education Department as “the difference between your annual income and 150 percent of the poverty guideline for your family size and state of residence.”

Under RAP, however, your dues would simply equal up to 10 percent of your AGI. Your payments may become less affordable over time, as AGI doesn’t account for increases in your cost of living. Imagine moving from Idaho to California, for example, or inflation rearing its ugly head again.

Another potential unintended consequence of RAP’s seemingly oversimplified formula: As fellow student loan lawyer Adam Minsky has written, your monthly payment could jump dramatically if you earn a modest raise or pick up a side hustle that pushes you up into the next $10,000 bracket (see No. 4, above).

6. Your monthly payments could increase under the new plans

A mid-June Student Borrower Protection Center analysis estimated that some borrowers will see their monthly dues spike on RAP as compared to currently available IDR plans.

To be fair, RAP, which coincidentally borrows its name from a plan used by borrowers in Canada, could also result in a lower monthly payment depending on the plan you’re coming from and other circumstances.

Keep an eye on the Loan Simulator

RAP and the modified standard plan are at least a year away from rolling out. Here’s hoping the Education Department wastes little time in adding them as options to consider in the Loan Simulator available at StudentAid.gov. This helpful tool allows you to input your loan details (or have them uploaded automatically by logging in with your FSA ID) and view your monthly and overall costs under each plan. Given the massive changes coming, this tool will be more helpful than ever.

7. Your RAP payment amount could decrease by $50 per month for each dependent on your tax return

On its face, that might sound significant, particularly if you have a large family. But the net benefit might not be as large as you think, particularly if you’ll be moving to RAP from an existing IDR plan. That’s because IDR accounted for a broader definition of your family size when calculating your monthly payment. It termed anyone as a dependent if you provided “more than half of their support.”

Tate offers the examples of cohabitating and supporting your elderly parents, or your domestic partner and their children (from a previous relationship): You’d get “credit” for this family situation on IDR, but not on RAP.

“We’re not honoring these dynamic family environments,” says Tate. He adds: “And so it leaves you with less money to pay toward those things because your student loan payment is higher — it doesn’t accurately reflect your responsibilities.”

8. Speaking of subsidies, RAP removes negative amortization

In plain English: Your monthly RAP dues are applied to your interest, fees and principal balance (in that order). And if your minimum payment doesn’t cover the interest, the remaining interest will be forgiven instead of being tacked onto your balance.

This feature, ironically piloted in the soon-to-be-obsolete SAVE Plan that conservative politicians have rallied against, is a big win for borrowers. The hope is that removing the capitalization of unpaid interest prevents runaway balances and gives you a better chance to pay down your balance over time.

9. The new plans are eligible for Public Service Loan Forgiveness (PSLF)

PSLF is likely to change, as the Education Department concluded a negotiating rulemaking process on July 2. However, the modified Standard and RAP plans are eligible if you’re pursuing relief related to your qualifying government or nonprofit employment. The Big Beautiful Bill’s only narrowing of eligibility adversely affects doctors and dentists, who will no longer be able to count residencies toward their PSLF progress.

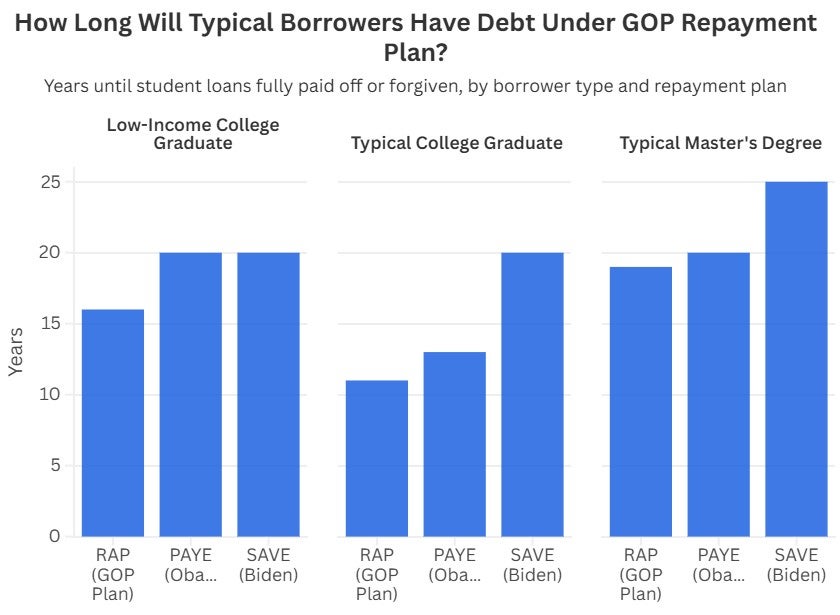

10. RAP-related loan forgiveness takes five years longer to achieve

If you’re on an IDR plan working toward forgiveness, you might have been expecting a clean slate after 20 or 25 years (depending on your plan). With RAP, it’s 30 years, which student aid expert Mark Kantrowitz has compared to “indentured servitude.”

| Repayment plan | Forgiveness after (years) |

|---|---|

| IBR (borrowed before July 2014) | 20 |

| IBR (borrowed after July 2014) | 25 |

| ICR | 25 |

| PAYE | 20 |

| RAP | 30 |

Plus, like with other federal loan relief programs, the fine print has footnotes. For example, as Campbell has written, it’ll be up to the Education Department to determine what constitutes qualifying payments for relief over the 30-year term.

What about tax on RAP-related forgiveness?

In a defeat for borrowers seeking IDR-related forgiveness, the BBB doesn’t extend an existing provision that makes such relief tax-free after 2025. That means if your balance is wiped away on RAP (or another IDR plan before 2028), you’ll likely be subject to federal income tax on the forgiven amount. That is, unless other student loan legislation comes to the rescue.

11. But if RAP works, you could be out of debt faster

The conservative response to the complaints about the “30-year debt trap” of RAP is to shift away from what Preston Cooper, a senior fellow for a right-leaning think tank, calls a “forgiveness-driven approach.”

“By frontloading assistance — borrowers get help paying down principal immediately [via subsidies], rather than waiting around for forgiveness — it aims to help borrowers retire their debts faster,” Cooper wrote for the American Enterprise Institute in May.

Cooper makes the argument, based on his own math, that borrowers will zero their balances faster under RAP. (Of course, they might also be forced to make higher monthly payments, as mentioned in No. 4, above.)

12. You could switch from RAP to the new Standard plan at a later date

Jason Delisle, most recently of the Urban Institute, described an earlier version of the bill’s RAP as a “roach motel,” because “you go in, and you can never check out.”

Fortunately, the roaches have relocated. Under the bill that’s now become law, you can switch between the two plans as needed. However, Campbell has estimated that it might only make sense to transition between plans if you experience significant changes in your debt-to-income ratio.

13. The new standard plan is the new default

If RAP or IBR isn’t your best option come 2026 (for new loans) or 2028 (current loans) — or perhaps you don’t select a plan at all — you’ll be automatically enrolled in the new Standard Repayment Plan.

Starting in July 2026, the standard plan resembles the Extended Repayment Plan that has long existed. Your term length depends on your loan amount, though you could always make extra, perhaps biweekly, payments to pay off your balance over a shorter period.

| New standard | Old standard | ||

| Loan amount | Term (years) | Loan amount | Term (years) |

| Under $25,000 | 10 | Any | 10 |

| $25,000 to $50,000 | 15 | ||

| $50,000 to $100,000 | 20 | ||

| Over $100,000 | 25 | ||

What’s your next step?

Fortunately for borrowers who already have federal student loans, the biggest impacts of the Big Beautiful Bill won’t hit immediately. The RAP and new Standard plan won’t even be available until July 2026. And we can already start to imagine potential rollout difficulties and delays.

So the best advice from this certified student loan counselor is this: Keep on keeping on. By that, we mean:

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here