Key takeaways

- To receive unemployment benefits, you need to have filed all the correct documentation, have your identity verified and have answered all the questions clearly.

- If something is missing in your documentation or your claim gets flagged, you may have to wait to receive your unemployment benefits.

- You can contact your state unemployment office to speak with a representative or update your documentation online to speed up the process.

U.S. unemployment stands at 4.2 percent, as of December 6, 2024, with a total of 7.1 million people getting unemployment benefits, according to the U.S. Bureau of Labor Statistics.

That amount of people applying for unemployment income (UI) every week can result in bottlenecking, as state departments work to process all those claims. Add to the mix that you have to have all your documentation precisely in order, with no errors, to receive your payments, and you have a recipe for delayed unemployment benefits.

“People who are waiting on these payments are people who are relying on meager state UI benefits,” says Michele Evermore, interim director of disability economic justice and senior fellow at The Century Foundation and former senior policy analyst at the National Employment Law Project, where she specialized in employment insurance. “They almost universally are being forced to make the choice between several terrible decisions, whether it’s getting a payday loan, putting money on credit cards, not paying rent, not buying medicine or not buying all the food they need. All of that is really scary.”

Here are seven reasons why your unemployment check might be taking so long to be paid and what you can do about the problem.

Reasons why you haven’t received your unemployment payments

1. Your state is slow to process jobless benefits applications

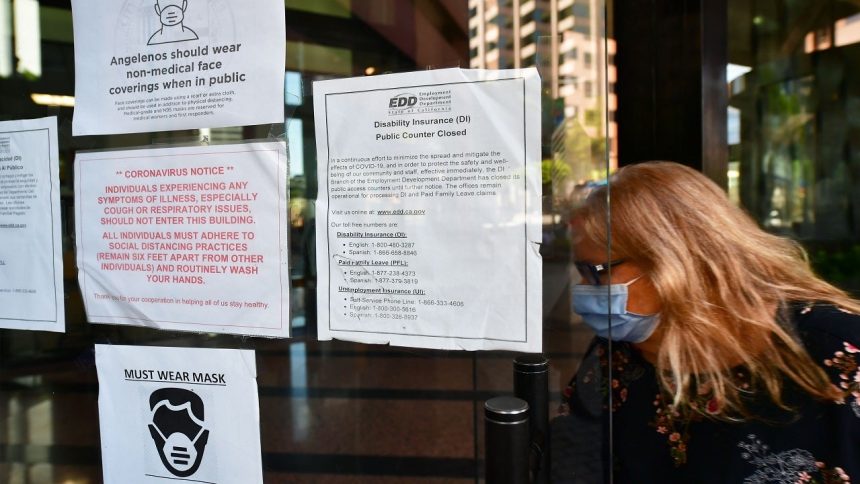

The most likely reason why you haven’t yet received your unemployment check is probably also the most frustrating: State unemployment agencies are hard-pressed to process them in a timely manner. This could be the underlying reason why you haven’t yet received your payment, whether you’re marked as approved or still pending.

It takes time for administrators to verify your information, work history, earnings and reason for leaving — hoops and hurdles before your checks start coming. Many states are also using outdated systems and technology to process these claims. States are also having to keep existing payments flowing while still figuring out how to process new claims. All of this can result in delayed unemployment payments, leaving the unemployed in a financial lurch.

2. Your application might be flagged for what you listed as your reason for job loss

Applications for UI have never been the easiest to navigate. That goes for both filers and administrators.

Your application might be flagged for further verification if you have a unique reason for losing your job, particularly if it might sound like you quit your position voluntarily. An example of that, Evermore says, could be someone who’s recently been injured and had to quit their job operating heavy machinery. While it may appear like you’ve left voluntarily, there’s actually more to the story that requires additional verification.

“Any slightly more ambiguous answer to that question puts you in a category that gets extra review,” Evermore says. “And once the system says we can’t automatically approve this because there’s a flag, then it has to go to the adjudicator.”

In other words, you will likely have a delay in receiving unemployment payments because administrators have to do extra verification to process your payments.

3. Your application might be getting vetted for fraud

State unemployment offices have been hit massively with fraud in recent years. Fraudulent applicants have used the names and personal information of people who have not lost their jobs, further overwhelming the system and costing states money.

To stop the problem, some states have started requiring more forms of ID. Some states also issue Form 1099-G to people who are receiving unemployment benefits so that they can report the income on their taxes. The federal government encourages people to report unemployment fraud if they receive one of these forms but have not received unemployment income, or otherwise realize that their identity has been stolen.

4. You may be missing documents in your application

While every state has individual documentation requirements, most applicants are generally required to submit their Social Security number, driver’s license, information about their employer, reason for leaving, first and last day worked, among other questions.

If you’re missing any of these documents or forgot to include something with your application that your individual state specifically requests, it might be holding up your claims.

5. You might not have provided the right payment profile

Perhaps your delay is as simple as not providing a preferred payment method for your weekly benefit. When you first apply for benefits, you’re also asked to provide information about your bank, including your routing and account numbers for direct deposit.

Labor Department officials have said that having a bank account on file can speed the process, but that’s not possible for the near 20 percent of U.S. households who are either unbanked or underbanked. In those instances, your state department might be preparing a debit card or prepaid card that you can specifically use to access your benefits, but that’s only going to take time.

6. You haven’t clicked yourself as certified to work

One of the simplest reasons why your payment might be delayed is that you didn’t fill out a weekly certification. Some states require that every week, to receive your benefits, you have to show that you were looking for work and/or “certify” yourself as able and ready to work if a position were to be offered to you.

If you’re not completing this step, the state unemployment office can’t process your weekly payment.

7. Your state might have run out of unemployment funds

As of January 2024, only 19 states’ unemployment funds met the solvency levels recommended by the federal government, according to the U.S. Department of Labor. That number is down from 31 states prior to 2020.

Some states, such as West Virginia, are looking to address the issue by reducing the maximum number of weeks that a person is eligible for unemployment. Other states, like California, are currently in billions of dollars of debt to the federal government for paying unemployment benefits — with no measures in place to mitigate the costs.

If you were approved for extra benefits but still haven’t received those payments, you should eventually receive them backdated, Evermore says. But if you’ve still been waiting on your application to be approved by the time the pot of money runs out, you’ll most likely not be able to receive those extra payments.

“If the money runs out, the money is out,” Evermore says.

What to do if you haven’t received your unemployment payments

1. Contact your state unemployment office

In most cases, it can be valuable to get through to your state unemployment office and speak with a representative. They can help you identify any pain points in your application and perhaps speed up the process for you, though some filers have trouble getting through to speak with an agent.

If you’re still waiting on an approval, it might also be worth a shot to reach out and see if they can review your application while you’re on the phone. That might help you obtain those extra benefits, depending on what state you live in, before they run out.

“For those who are still struggling to receive payments, they should do their best to get in touch with a real person in the agency responsible to understand the source of the bottleneck,” Mark Hamrick, Bankrate’s senior economic analyst and Washington bureau chief, says. “If that effort isn’t successful, contact a local or state elected official to ask for their assistance to try to break through the logjam.”

2. Submit any new forms of identification or documentation

In instances when you’re worried about being vetted for fraud or missing documents, it’s worthwhile to log into your unemployment application and submit any new documentation. You should also consider uploading a new picture of your ID or another form of identification that your state agency can use to verify your claims.

3. Update your payment profile

That also goes for updating your payment profile. If you perhaps forgot to submit your direct deposit information or got a new bank account since applying for your benefits, be sure to log back in to your online account or work with a representative in person or over the phone to update that information as quickly as possible.

4. Work with any lenders or companies you regularly pay a bill to

In the meantime, while you wait on your payments, review your budget and make a list of everyone you regularly pay a bill to and work with. It’s worth reaching out to all of those lenders and firms to see if they might be able to help work out a payment plan while you await more income through UI.

They also might be able to reduce your monthly payment.

5. If you’re denied, apply again

Most experts are in agreement that you should always re-apply if you believe you were mistakenly denied a benefit. Whether it was a mistake on the state agency’s end or your own, filing again is worth a shot.

6. Be patient — and contact your state representatives

Unfortunately, however, waiting for your UI benefits is often just a waiting game.

But you’re not entirely defenseless while you wait for your payments. Evermore recommends reaching out to your state representatives and lawmakers, letting them know about the issues you’ve faced. That way, you bring the problems to their attention and they feel more pressure to make changes.

Frequently asked questions

The bottom line

If your unemployment status says you’re active, but you’ve received no money for your unemployment benefits, there could be one of several problems happening: You might not have answered some questions correctly on your unemployment form, you may need to update your payment information or your state may just be taking a long time to process claims.

The golden answer to ensure that you receive your payments is to get on the phone with the state unemployment office to find out why your unemployment benefits are late. If you’re stuck waiting, you may need to negotiate with your bill providers or use savings to stay on top of your bills.

Waiting can be difficult, especially when your bills are stacking up, so it’s worth it to let your state representatives know your predicament. If they know how difficult accessing unemployment income is, they can effect change at the policy level to improve the unemployment benefits system.

Read the full article here