Key takeaways

- The CFPB allows consumers to file complaints about unfair, deceptive or abusive financial practices across products like bank accounts, credit cards, mortgages, debt collection and student loans.

- While you don’t have to contact the offending company first, doing so may resolve the issue more quickly and save you from filing a formal complaint with the CFPB.

- Once submitted to the CFPB, complaints are sent to the company, which typically responds within 15–60 days. Consumer feedback on the outcome helps inform the CFPB’s broader enforcement work.

If you’re having trouble with a financial services company and need help resolving it, you can file a complaint with the Consumer Financial Protection Bureau in only a few steps. To file a complaint, you just need to create a CFPB login account and complete an online form describing your issue and attach supporting documents to strengthen your case.

The CFPB allows consumers to file complaints for harm caused by unfair, deceptive or abusive practices, including against a bank or credit union to ensure that “markets for consumer financial products are fair, transparent, and competitive,” according to the agency’s website.

If you believe you’ve been subject to unfair, deceptive or abusive practices by a financial company, here’s how you can file a CFPB complaint.

Where do you file a CFPB complaint?

The CFPB’s website includes a dedicated filing page where you can find the portal to submit a new complaint, in addition to resources detailing what should be included in the filing.

Which products and services can consumers complain about?

Products and services consumers can complain about include:

- Checking and savings accounts

- Credit cards

- Debt collection

- Mortgages

- Student loans

If you believe you’ve been subject to unfair, deceptive or abusive practices by a financial company, here’s how you can file a CFPB complaint.

A step-by-step guide to filing a CFPB complaint

Before you start, you’ll need to create an account with the CFPB. You’ll need to submit your name, email address, phone number and create a password. After verifying your email, you can start the filing process.

Step 1

The first part of the filing is guided. You’ll have several options to choose from to indicate what your complaint is about. In step one, you’ll choose which product or service best matches your complaint.

This could be, for example, about a deposit account such as checking, savings or certificates of deposit. Or you could choose mortgages, which would include such products as conventional home loans or home equity loans or line of credit (HELOC).

Step 2

In step two, you’ll indicate which problem you’re having. For example, if you’re having trouble with overdraft fees, you’d first select “problem caused by your funds being low” and then select “overdrafts and overdraft fees.”

At this stage, you can also indicate whether you’ve reached out to the respective company about the issue you’re having. If you’ve already reached out to the company, you can indicate what information you requested from them in the complaint.

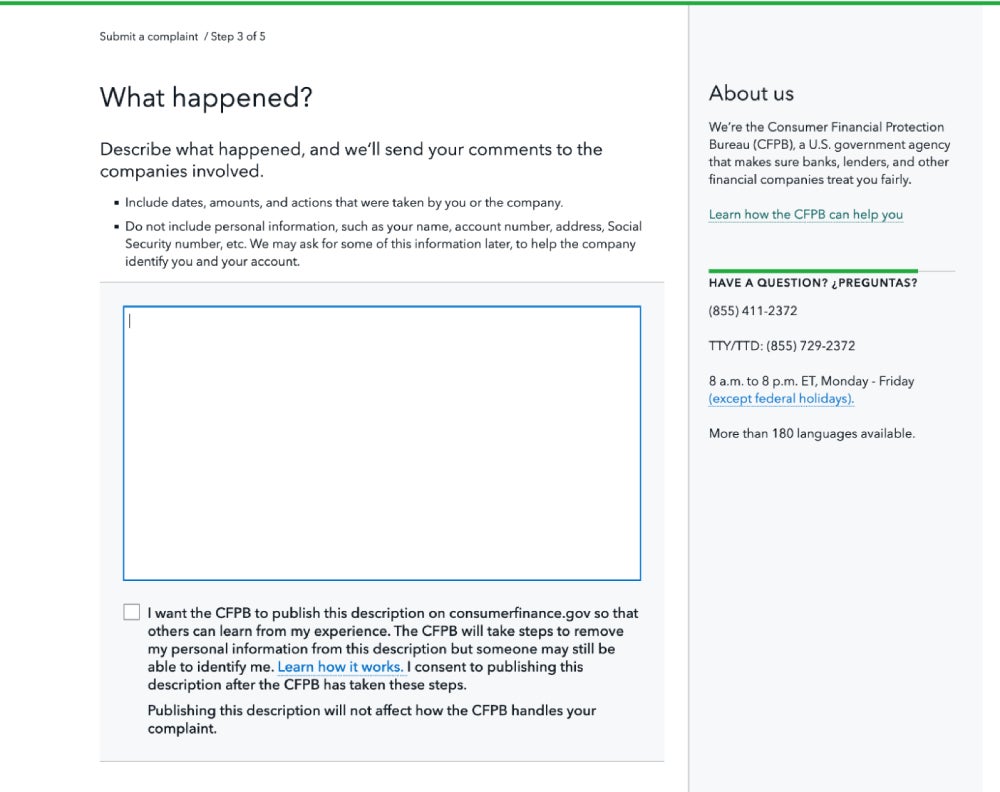

Step 3

In step three, you’ll be able to write directly into a text box to describe what happened. You’ll also be able to indicate what you believe would be a fair resolution to the issue you’re having. You can also attach any documents that would support your claim (the limit is 50 pages). For example, you could say you want a refund for a late fee because it was charged unfairly.

Be sure to include all the important dates, dollar amounts and communications you’ve had with the company you’re complaining about.

Because you can’t file a second complaint about the same issue, you’ll want to make sure you’re making the best case you can to describe your issue.

At this step, you’ll also be able to indicate whether you’re OK with the CFPB publishing the description of your complaint to its website. (The CFPB will take steps to remove your personal information, so that you can’t be identified.)

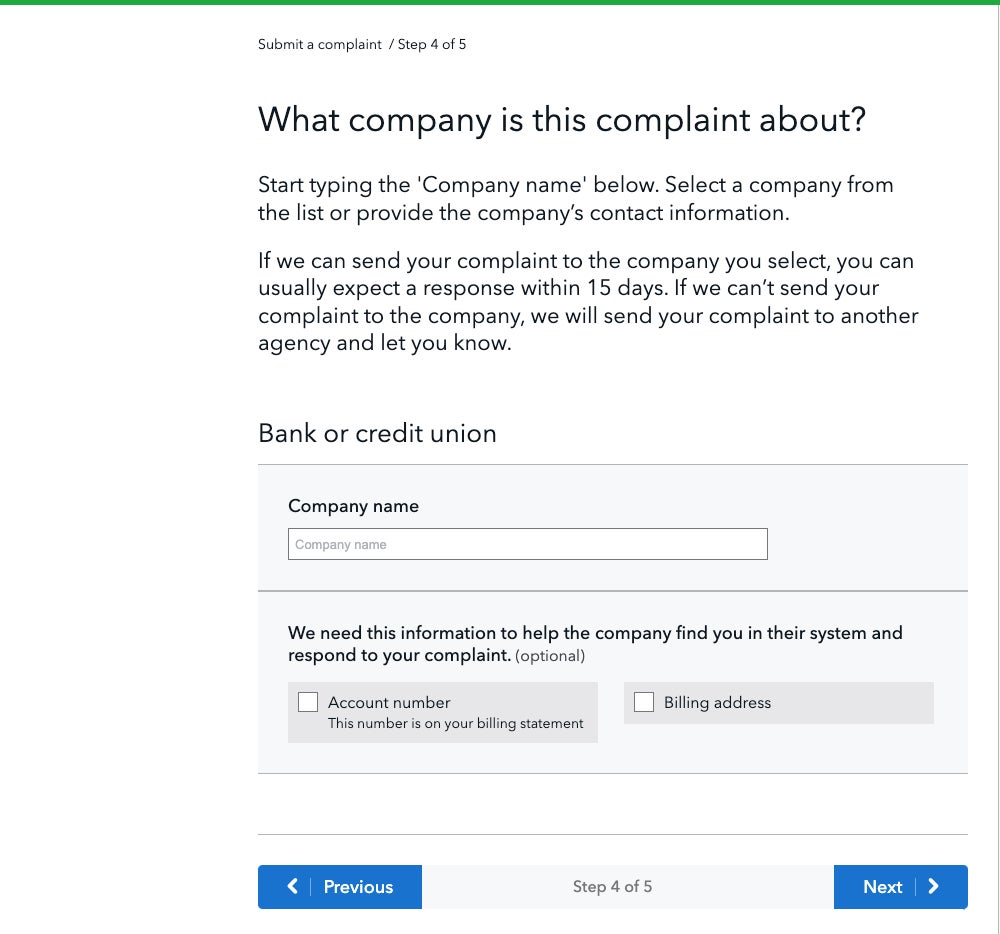

Step 4

In step four, you’ll indicate which company you’re having a problem with.

If you’re complaining about a bank, you’ll have the option to include specific information about your account, including your billing address and account number.

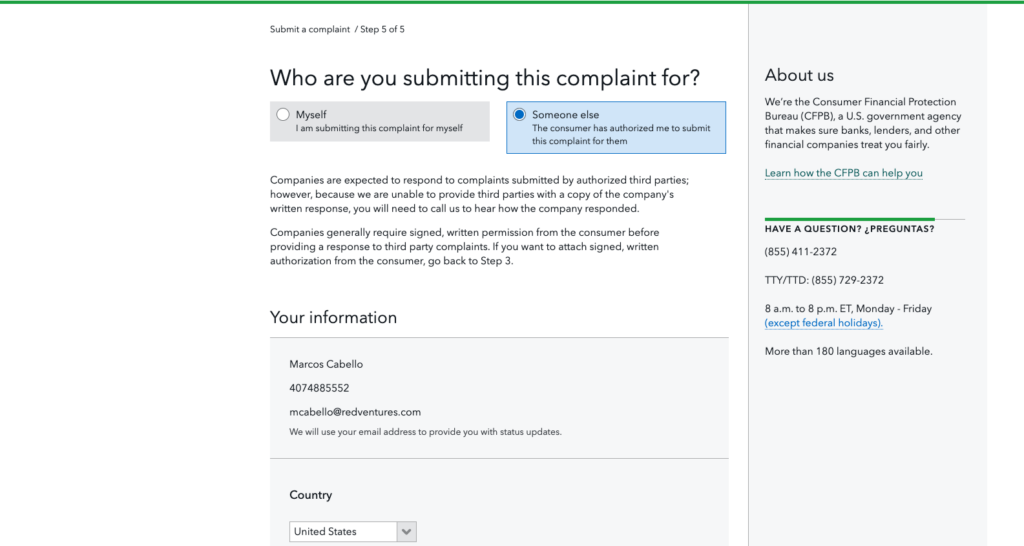

Step 5

In step four, you’ll indicate which company you’re having a problem with.

In Step 5, you’ll say who you’re submitting this complaint for (yourself or for someone else). You’ll then be able to add your personal information so the CFPB can contact you with updates about your complaint.

When should you file a CFPB complaint?

Try contacting the company first.

If the company is unresponsive or unwilling to cooperate, that’s when it makes sense to escalate and file a complaint with the CFPB. The bureau can step in to ensure your concerns are addressed, and the company is held accountable.

What happens after submitting a CFPB complaint?

After receiving your filing, the CFPB will send your complaint to the relevant company, which will review the issues raised.

Companies typically respond within 15 days, though some companies take up to 60 days to provide their final response. In the latter case, the company will typically acknowledge your complaint is in progress before providing you with a final response.

After the company responds, you’ll have 60 days to provide feedback through a post-complaint survey, which will be forwarded to the company. This is the last stage for filers — whether or not you are satisfied with the resolution.

Bottom line

If you’re having issues with a financial service provider — be it with overdraft fees, a HELOC, or student loans — filing a complaint with the CFPB can help you get to a resolution. It may be worth attempting to work the problem out with the company first, but that isn’t a requirement to submit a CFPB complaint. And if the resolution isn’t satisfactory, you can indicate so in the post-complaint survey, which the CFPB provides directly to the institution in question.

Frequently asked questions

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here