Key takeaways

- The Chase mobile app offers a range of useful features to help cardholders manage rewards, pay bills on the go and more.

- App users can also send money to family and friends with the app’s Chase QuickPay with Zelle feature.

- Get the most out of the Chase app by using it to monitor your spending and bills, and to watch out for fraudulent activity on your accounts.

The Chase Mobile app is an all-inclusive platform that provides a centralized way to manage all your Chase accounts. The app allows owners of any Chase card — credit or debit — to bank from the convenience of their phone in almost any location.

The app is supported by both Android and Apple devices, so you can rest assured it is regularly updated and improved for users on both mobile platforms. It also offers a range of useful features that can make banking with Chase a breeze, including QuickDeposit, Chase QuickPay with Zelle, the ability to see a routing number and account number, location services and financial reporting through Today’s Snapshot.

Not surprisingly, the Chase mobile app is highly rated by consumers. The app has garnered 7.2 million ratings and earned a 4.8 out of 5 ranking on the Apple App store and 4.4 out of 5 stars across more than 1.8 million user reviews on Google Play. It offers a wide range of mobile banking services that simplify and speed up on-the-go banking as well.

What services are available via the Chase mobile app?

The Chase app offers a wide range of services that can be helpful when you have checking or savings accounts with the bank, as well as any of their top credit cards. The app can also be useful for Chase mortgage or auto loan account holders.

Here’s an overview of everything you can do with the Chase mobile app, depending on the account types you have.

- QuickDeposit

-

QuickDeposit lets Chase customers scan deposit items such as checks and use the images to make deposits electronically. This feature is largely standard among larger banks, but its convenience shouldn’t be overlooked.

- Chase QuickPay with Zelle

-

QuickPay is a popular feature of the Chase app that lets Chase card owners make person-to-person money transfers in real-time. Use of QuickPay is supported by Zelle, and while it’s primarily used by Chase customers, money can be transferred to people without a Chase account if they sign up with their email address or phone number.

- Chase Pay Over Time

-

The Chase mobile app lets you break up recent purchases of $100 or more into equal payments with no interest, although a fixed plan fee applies. The app allows you to activate this feature on eligible purchases.

- Replace your card

-

If your card is lost or stolen, you can use the app to request a new debit or credit card.

- Mobile wallet payments

-

The Chase app lets you add credit and debit cards for contactless payments to digital wallets like Chase Pay and Apple Pay. This lets you use your smartphone to make contactless payments instead of the card itself.

- Unlock and lock your card

-

If you’ve lost or misplaced your credit or debit card, you can lock it from your Chase mobile app to prevent purchases or prevent cash advances. If you locate your card, you can unlock it from the app as well.

- Sign up for overdraft protection

-

You can apply a setting to your checking account that automatically transfers money from your savings account to your checking account should you overdraw it.

- Autosave

-

Create a savings goal and track your progress. You can direct automatic transfers to your savings account to help you meet your goal.

- Credit Journey

-

Enroll in Chase’s Credit Journey program from the app. Once you enroll, you can check your credit score, monitor your credit activity and learn more about how your credit score works.

- Set up your budget

-

Use the budget planner tool to stay within your spending goals. You can turn on “daily pacing” to help you stay within your budget. You’ll get tips in the app if you are overspending or coming in under budget.

- Chase First Banking

-

If you have minors with a Chase First Banking account, you can set up, monitor and perform other actions for their account. Some functions include making transfers, setting up a recurring allowance, creating chores and accessing account services.

- Chase Offers

-

Add offers connected to your Chase credit card and check the amount you’ve earned to date. Chase Offers can give you cash back at various retailers when you meet minimum spending and offer requirements.

- Chase Ultimate Rewards

-

Check your Ultimate Rewards balance, access the Chase Travel℠ portal, check card benefits, transfer to travel partners and more.

- Activate bonus categories

-

If you have the Chase Freedom Flex®*, the Chase mobile app lets you activate the card’s quarterly bonus categories so you can earn 5 percent cash back on up to $1,500 spent in eligible purchases every quarter with activation (then 1 percent).

- Send a wire transfer

-

Save money by sending a domestic wire transfer directly from your Chase app.

- Location features

-

The location feature within the Chase app saves you the trouble of having to exit your app to search for directions online. Through the app, card owners can locate the nearest ATM or Chase branch in their area.

- Today’s Snapshot

-

One of the most interesting and unique features of the Chase app is an option found at the top of the main page called “Today’s Snapshot.” This section of the app shows not only your daily spending habits but also helps you see your overall spending trends by breaking down your monthly spending into categories such as food, entertainment and gas.

- Management of car loans, mortgage and investments

-

The convenience and accessibility of the Chase app are further highlighted by the features that allow you to manage your car loan, mortgage and investments all from one application. These features won’t be used by all Chase cardholders, but if they apply to you, you can make your finances more streamlined through one all-inclusive portal.

How to navigate the Chase app

The Chase app offers a user-friendly experience that is simple once you understand the main features and overall layout.

When you open the app, you first see the main menu that shows all your active Chase accounts. Your checking account, credit card balance, car loan and investments are clearly visible, and if you click on any of the aforementioned categories, the app will open the individual pages with more information.

EXPAND

Off the main menu, you can also find Today’s Snapshot, which helps Chase card owners easily track their spending habits.

EXPAND

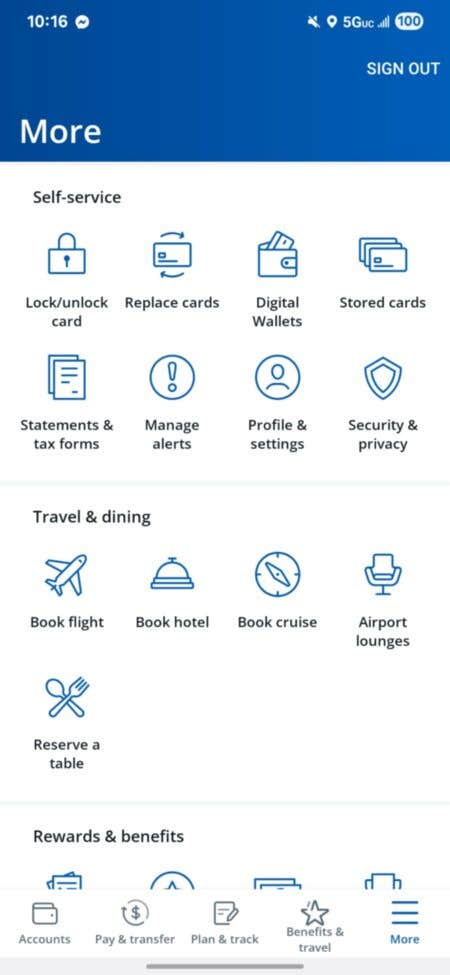

The “more” menu located on the bottom right-hand corner of the app lets you navigate to other options. From the “more” menu, you can lock or unlock your card, set up digital wallet payments, redeem your rewards or check out your card’s perks and features, among other moves.

EXPAND

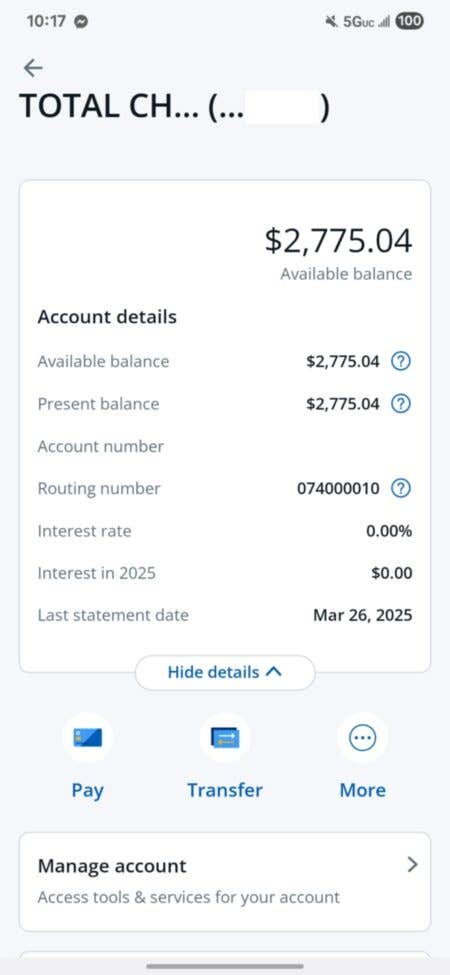

Perhaps one of the most common questions for anyone with a credit card or debit card is “How do I find my routing number?” With the Chase app, finding your account and routing number is simple. From the main profile, you simply tap on the section labeled “account.” From there, you click on “show details,” and then you can see your account number, routing number and interest rates.

EXPAND

What security features does the Chase app have?

The Chase app is protected by a 128-bit encryption for all of your personal account information, data and messages. This information can only be decrypted by the app on your phone — keeping it safe from potential hacks and information breaches.

Chase also uses two-factor authentication to verify your sign-in attempts. When you sign in for the first time or with a device the Chase servers don’t recognize, it’ll ask you for your username, password and a temporary identification code, which is sent to you by phone, email or text message. Once you enter the identification code, you’ll be securely signed in to your accounts.

If your phone uses facial (Face ID for iOS and face unlock for Android) or fingerprint recognition to authenticate your sign-on attempts, you can use these features to access your Chase accounts on the mobile banking app instead of a password. If your phone doesn’t have facial or fingerprint recognition capabilities — or you just don’t want to use these features — then you can use a standard password instead.

Keep in mind:

You can set up additional security features via the Chase Credit Journey program. Specifically, you can use the app to set up credit and identity monitoring that can alert you if there are changes to your credit report or your information is found on the dark web.

How can I get the most out of my Chase mobile banking app?

The best way to use your Chase mobile banking app is to check it frequently for updates regarding your accounts. The app will help you monitor your Chase accounts for both security purposes and to maintain good financial habits when it comes to managing your money.

You can also use the app to keep track of your regular spending and purchases, and to watch out for fraudulent activity on your credit card accounts. If you discover purchases that aren’t yours on your Chase credit card, you will be covered by the issuer’s $0 fraud liability protection. This means you won’t be on the hook for purchases you didn’t make, but only if you spot them and report them to Chase.

Why won’t my Chase mobile app load?

You should keep the app updated so that you have access to new features and fixes that the development team rolls out. Plus, the performance of the app is much better when you are connected to a strong Wi-Fi signal. If not, many pages may load slowly or not display at all. This can make for an frustrating user experience.

If you ever experience problems with the app, check your Wi-Fi signal, close and reopen the app or check for updates. You can also uninstall the app and reinstall it. If it still doesn’t work for you, you can contact the internet banking support group via phone or visit a local Chase branch, where a personal banker may be able to troubleshoot your app issues.

Bankrate’s take on the Chase mobile app

What sets the Chase app apart from the crowd are features such as Today’s Snapshot and Chase QuickPay. While neither of these features alone is a singularity within the online banking market, Today’s Snapshot does what you would normally need a separate application (such as Quicken or Expensify) to achieve.

Along these lines, Chase’s person-to-person payment platform, Chase QuickPay with Zelle, is also not alone in the market of transferring money — popular apps such as Venmo and Cash App have a similar structure — but its benefit comes in the form of convenience.

At the end of the day, is the Chase Mobile app going to change your life? Probably not. What it will do is serve as a streamlined app that makes banking and managing your money a simpler and more user-friendly experience.

The bottom line

If you have Chase credit cards or a checking or savings account with the bank, you’ll want to download the Chase mobile app to your smartphone. Doing so makes it easier to complete at least some of your banking tasks on the go, and you can even use the app to set up your favorite digital wallet so you can use your phone for contactless payments.

You can also redeem your rewards via the app, and you can quickly freeze or unfreeze your card with a few clicks of a button. Plus, since Chase takes account security seriously and helps you protect your information and account details in so many ways, you can rest assured the Chase mobile app won’t put your information at risk.

*The information about the Chase Freedom Flex® has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the issuer.

Read the full article here