Key takeaways

- Most major credit card issuers offer the option to easily lock and unlock cards through their online accounts or mobile apps.

- Locking a credit card can prevent impulse purchases and keep the account safe from fraud.

- Recurring transactions will still go through while a credit card is locked.

Did you know you can lock your credit card any time you don’t want anyone to use it? Whether you’re trying to prevent yourself from making impulse purchases or keep a family member from accessing your credit account, a credit card lock can stop new charges while still allowing previously authorized charges, such as subscription payments or scheduled bill payments, to process as usual.

For example, maybe you’ve misplaced your credit card and want a chance to look for it before you contact your credit card issuer about a replacement. A credit card freeze gives you time to find your card without having to worry about someone else finding it first.

Locking a credit card is easy, and most credit card issuers allow you to manage your credit card locks from your online account or mobile app. Here’s everything you need to know about locking and unlocking your credit card.

What does locking your card do?

A card lock is a feature that allows you to lock or freeze your credit card account for a certain period of time. Many people use card locks to prevent themselves or others from making unwanted purchases. Concerned you’ll fall prey to an impulse buy? You’re not alone. According to Bankrate’s Social Media Survey, 48 percent of social media users made an impulse purchase in 2023, and 68 percent said they later regretted at least one of the purchases.

So, locking a credit card can be a convenient way to stop poor spending habits in their tracks. The process is quick and easy, and most credit card issuers allow you to manage your card locks through your online account or credit card app.

A card lock or credit card freeze also prevents anyone from making unauthorized or fraudulent purchases on your credit card account. Most credit card locks still allow recurring automatic transactions, such as subscriptions or bills, to go through. That way, you can lock your credit card without having to worry about falling behind on your bill payments.

What transactions are allowed while locked?

Although locking your credit card is effective in stopping any new charges, there are still some that the lock will not apply to. Recurring charges that have already been set up will continue to process per usual, such as:

- Utility bills

- Monthly subscriptions, such as streaming services, gym memberships, magazines or cable TV

- Any other automatic payments already in place

These types of charges often have an indicator set up by the merchant that signals the charge is recurring and will likely happen again. If you have monthly payments already set in place, they will likely not be affected when you lock your credit card.

Reasons to lock your credit card

- A credit card lock can help keep your credit card account safe from fraud. If you have reason to suspect that your credit card number has been compromised, a card lock is one way to keep third parties from making purchases on your account — though you’ll probably also want to contact your issuer to report credit card fraud and request a new card.

- You can freeze your credit card account if you accidentally misplace your credit card. You may want to consider locking your card if you think you’ll be able to find your credit card in a day or two. In some cases, you should deal with a lost credit card by contacting your credit issuer and requesting a replacement. A card lock can protect your account until you decide whether your credit card is gone for good.

- Locking your credit card account can prevent you from making new purchases on the card. If you are trying to curb impulse shopping or stay out of credit card debt, locking your credit card can help you refrain from making purchases you might later regret.

- You can use a card lock as a way to keep an old credit card account active. Closing an old credit card can hurt your credit score, so consider putting one or two subscriptions on the card, setting up auto-pay to ensure that you don’t fall behind on your payments and locking your card to prevent yourself (or anyone else) from making new purchases on the account.

Credit card issuers that offer card locks

Most credit card issuers offer some type of card lock or credit card freeze. Here’s how to get a card lock or set up a credit card freeze with some of the biggest credit card issuers:

American Express

You can quickly freeze and unfreeze your American Express credit card by logging into your account or using the American Express App. Freezing your Amex card prevents it from being used for new purchases, but recurring bills and subscriptions will not be affected. You will still be able to make purchases through a digital wallet while your card is frozen, and you may be able to make purchases at online retailers if your card is already stored as a method of payment.

If you do not unfreeze your card within seven days, American Express will automatically unfreeze it for you.

EXPAND

Bank of America

Bank of America allows you to lock and unlock debit cards, but does not offer the same feature for credit card accounts. If you want to lock or unlock a Bank of America debit card, log into your online account or use the Mobile Banking app. Locking your debit card will prevent new purchases, but recurring transactions and scheduled bill payments will still go through.

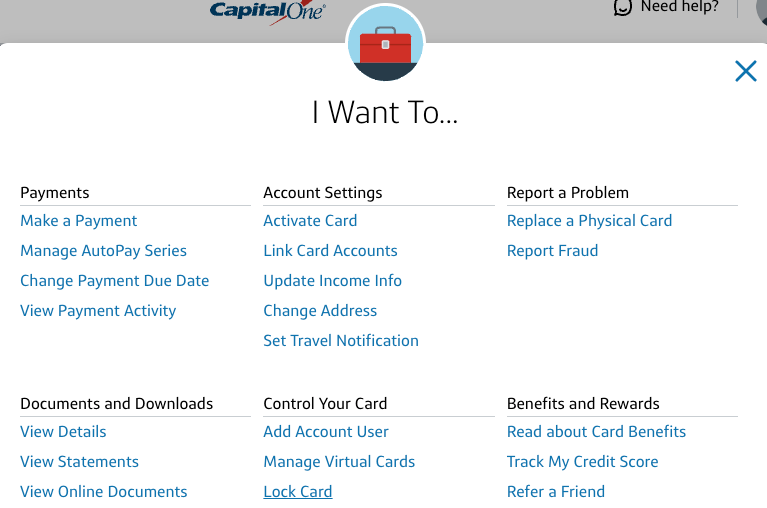

Capital One

Capital One’s card lock feature can be accessed through the Capital One Mobile app. Locking your credit card prevents new purchases, and you can unlock your card when you are ready to start using it again.

EXPAND

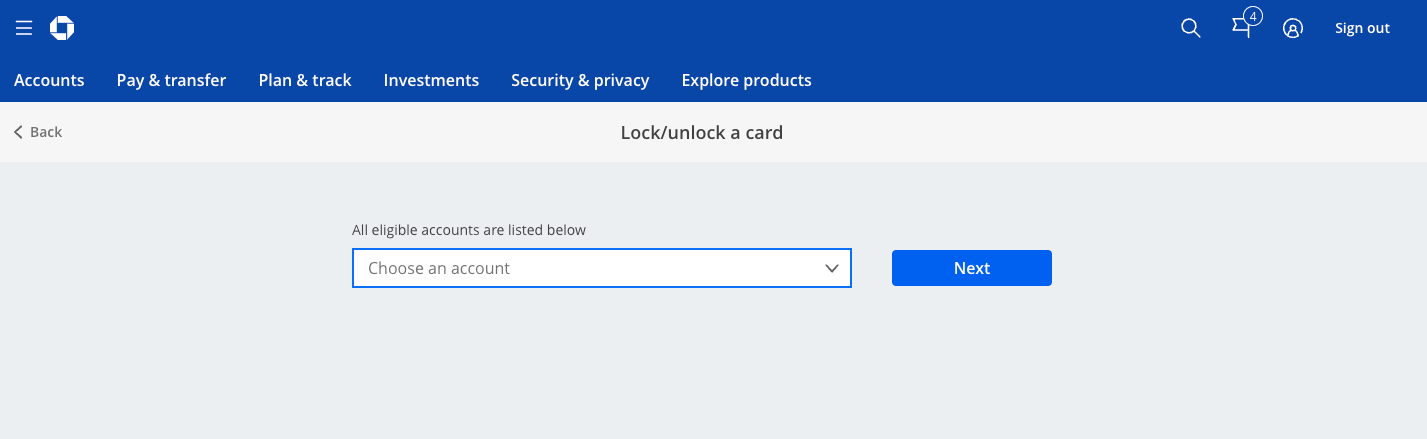

Chase

You can easily lock and unlock your Chase credit card or debit card through the Chase Mobile app. Locking your card prevents new purchases, cash advances and balance transfers. Recurring transactions will still go through, and you can still make purchases through a digital wallet.

EXPAND

Citi

Use Citi Quick Lock in the Citi Mobile App or in your online account to lock and unlock your Citi credit cards. New charges will be blocked, but recurring transactions will continue to process as usual.

Discover

Setting up a credit card freeze with Discover prevents new purchases, balance transfers and cash advances. Recurring transactions, such as subscriptions, will still occur even while your card is frozen. You can easily freeze your account online, through the Discover Mobile App or over the phone, and you can freeze and unfreeze your account as often as you like.

Wells Fargo

You can temporarily turn off your Wells Fargo credit card account by logging into online or mobile banking. When your credit card is turned off, most types of new transactions will not be processed — but previously authorized recurring transactions will be processed as usual.

The bottom line

Locking a credit card prevents anyone from making new purchases on your credit card, and you can use credit card locks to keep your account safe, prevent impulse shopping or stick to a monthly budget.

In most cases, getting a card lock in place only stops new purchases. Recurring transactions, like subscription charges or monthly bills, can still go through. If you want to set or lift a credit card freeze, log into your online credit card account or use your credit card issuer’s mobile app.

Read the full article here