Key takeaways

- The American Express Apply With Confidence tool goes beyond preapprovals and prequalifications to give you a definitive answer to whether you’d be approved for certain cards.

- Using this tool can help you avoid credit card rejections and unnecessary hard inquiries on your credit report.

- However, the tool has certain restrictions, such as being limited to those applying for their first Amex card.

Have you ever been afraid of applying for a new credit card? Maybe you have a mortgage application on the horizon. Perhaps you’re in the market for a car loan. Many major life decisions involve having the best credit score possible, which a hard credit check or credit card denial can negatively affect in the short-term.

No matter the reason, there are times when a new inquiry on your credit report could drop your credit score right when you need it in top shape. But what do you do if you need the added buying power of a new credit card? The American Express “Apply With Confidence” tool can help you remove the guesswork by giving you a risk-free application process that won’t impact your credit score.

What is Apply With Confidence?

In 2022, American Express launched the “Apply With Confidence” tool to allow prospective applicants to check if they will be approved for a specific American Express card with no impact on their credit score.

Apply with Confidence enables applicants to determine whether they will be approved for their chosen card before they go through the step — and the hard credit pull — of a full card application.

Apply with Confidence vs. preapproval vs. prequalification

Amex’s Apply With Confidence tool differs from other issuers’ preapproval and prequalification options in that it offers a definite “yes, you’re approved” or “no, you aren’t approved.” With other preapproval and prequalification tools, applicants receive information regarding their odds of being approved, but not a true approval or denial.

As with other prequalification tools, the Apply with Confidence tool uses a soft credit check to determine whether an applicant meets the criteria for approval. However, the Apply With Confidence tool goes a step further by giving you a risk-free decision and the chance to back out before Amex conducts a hard credit inquiry that will impact your credit score.

Who is Apply With Confidence for?

The Apply With Confidence tool is for people interested in applying for their first American Express credit card.

It isn’t available or necessary for existing cardholders because American Express generally doesn’t perform hard credit inquiries when determining eligibility for current cardholders applying for a new product. Instead, existing cardholders receive targeted offers through their account or through email or snail mail.

Which types of cards qualify?

The Apply with Confidence tool isn’t available for business credit cards — only consumer cards.

How does the Apply with Confidence tool work?

The Apply With Confidence tool serves as a risk-free application process. It isn’t an ad you need to click through or an offer you need to activate. If you see the banner when you visit the American Express site to apply for a card, you’ll be automatically directed through the Apply with Confidence tool when you click on a card’s Apply Now button.

EXPAND

This means American Express will run a soft pull, which doesn’t impact your credit score, to determine whether you’re approved. A soft pull reveals your personal information as well as some of your credit history, such as how many open credit accounts you have and your payment activity, including late payments or collections.

How to use the Apply With Confidence tool

Using the Apply with Confidence tool comes down to filling in a few fields of a form. It’s that simple. The most difficult part is choosing the best credit card for your situation to start the process.

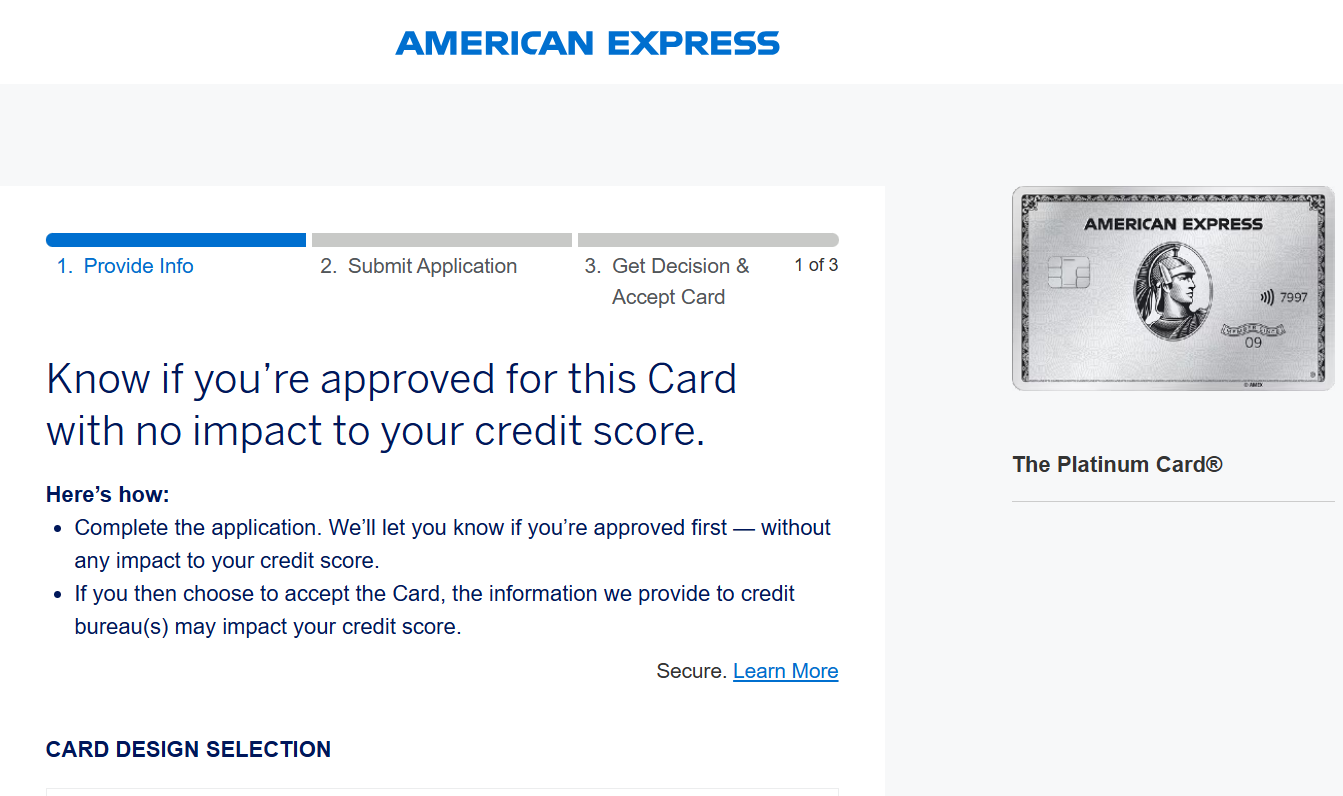

Once you click “Apply Now” for your chosen card, here’s what the first step of the process looks like:

EXPAND

Once you enter your personal information, including your name, address, household income and Social Security number, you’ll click “Continue to Terms” and arrive at a page asking you to review some terms and conditions before submitting your application:

EXPAND

Then, once you submit your information, American Express will tell you whether you’ve been approved and give you the option to accept the card offer.

At this stage, you will also see details about the amount of your welcome bonus offer, if applicable. You could also encounter a pop-up window informing you that you aren’t eligible for the welcome bonus, which could occur if you’ve exceeded Amex’s eligibility rules or have previously received a welcome bonus on the same or similar card.

If you accept the card after reviewing this information, Amex will then submit your application for a hard credit inquiry. That credit check will temporarily affect your credit, but at least you know it was worth it and you have a new card on the way.

If you aren’t approved, American Express will give you the opportunity to exit your application before it’s fully submitted. This allows you to avoid a hard credit check for a card you already know you won’t qualify for.

The bottom line

Amex’s Apply With Confidence tool is one of many ways that the issuer leads the field in transparency during the application process. Other issuers could learn from Amex and adopt some of its consumer-friendly application policies.

Getting a new credit card is already a big decision. You should feel confident and comfortable in your approval odds when applying for cards before taking a hit to your credit score, which is exactly what Apply with Confidence offers.

Read the full article here