Mint, one of the best budgeting apps, shut down early in 2024. As longtime budgeting fans, we’ve had a difficult time finding a replacement with in-depth net worth tracking that’s both affordable and easy to use. In order to find our ideal budgeting software, we spent hours researching the best budgeting apps on the market, and this round-up is the result.

Our top pick ended up being Lunch Money, but this article has reviewed a variety of software options to help you find a solution that works for you, whether you’re a flexible budgeter or envelope method enthusiast. Check out the list below, and let us know if there are any noteworthy budgeting apps we missed by leaving a comment or emailing me.

1. Lunch Money

Lunch Money is the newest and perhaps most interesting budgeting app on the scene. The app is the brainchild of Jen Yip, an experienced Silicon Valley developer. One of the main features that makes it unique is crypto integration, which allows you to track the value of your digital currencies alongside your other investments. There’s also multi-currency support for digital nomads and other users who spend and save in more than one currency.

The platform has a streamlined, intuitive design, and allows you to create unlimited budgets with custom categories. Lunch Money can suggest budget amounts for you based on past budgets or spending. Unspent funds from last month can even be rolled over automatically and added to your spending targets. Automatic expense tracking is another area where this software really shines because it’s so accurate. You can even fine-tune the rules used to categorize your purchases and add tags to batch transactions purchases together, such as travel costs for an upcoming vacation. Best of all, its basically automatic. You don’t have to do data entry.

For easy viewing, you can filter your transactions using criteria like category, account or payee name, tags, and date ranges. Lunch Money even compiles reports on patterns it notices within your spending. You’ll receive a monthly email that summarizes your transactions and highlights your most expensive purchases. Plus, you can use the analytics tool to spot trends in your financial behavior, like which categories you tend to spend the most on.

Getting Started

Lunch Money is web-only, which means there isn’t an official smartphone app. However, Lunch Money’s community of developers has created unofficial add-ons, including a smartphone app and Zillow integration to track real estate values. Lunch Money offers a 30-day risk-free trial and a pay-what-you-can pricing model that costs between $50 and $150 per year. If you don’t want to pay annually, there’s also a $10 per month option. Once you’re signed up, you can securely sync your bank account information using Plaid.

You can sign up for Lunch Money here

2. Windfalls AI

While technically not a budget app, Windfalls AI, known as Windfalls, is the latest “we negotiate your bills for you in return for a cut of the savings” company. The model is basically tried and true, with established players like Billtrim being available. However, what makes Windfalls interested in they have managed to work up a very slick AI which actually negotiates on your behalf. This is interesting because the AI basically deals with doing all the calling and negotiating.

The reality is big service providers like Comcast or your credit cards are constantly looking for ways to raise prices on you, so you might as well have technology on your site that lets you reduce your costs automatically and passively.

Getting Started

Windfalls is web only. Web only which means if you want to sign up, you’ll have to use your browser, there isn’t a smartphone app. Sign up is pretty easy. What you need to do is navigate to their site and open an account. Then upload all the bills you want to save money on. The website pretty much takes care of the rest. When their software has done its work, they’ll notify you and send you a bill.

The whole process is effective and a fresh take on an established savings model. There is some manual work, but it’s only like 20 minutes worth of effort, and you can actually save money with the software, so its worth it.

You can sign up here.

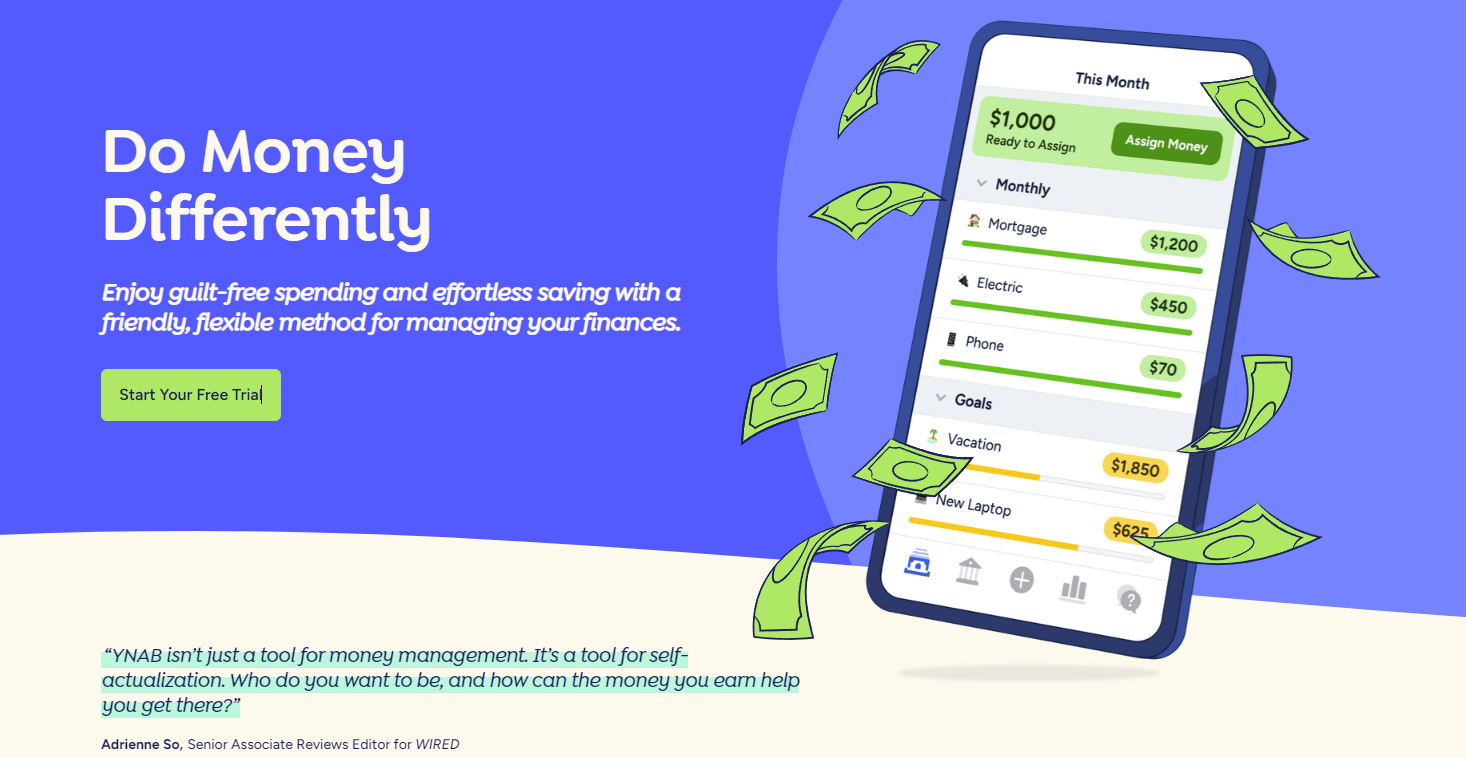

3. YNAB

You Need a Budget is one of the best budgeting apps for people who prefer zero-based budgeting, which involves giving every dollar you earn a specific job. YNAB allows you to create separate line items for your recurring bills, variable expenses, savings goals, and debt repayments. Throughout the month, you’ll assign money to each of these line items to ensure they’re all fully funded by the due dates. YNAB also syncs with your bank account and credit cards to automatically keep track of and tag your transactions. If you overspend in a certain area, you’ll be prompted to reassign funds from other categories to avoid a financial shortfall.

Some users say that the software is complex and has a bit of a learning curve. New users must put in some legwork to understand the methodology behind YNAB in order to use it. For example, the app has jargon you’ll need to learn, such as age of money, wish farm, and true expenses. YNAB publishes instructional articles to help you get started, and there’s an active Reddit community that can answer your questions.

Getting Started

YNAB has a web version and apps for your smartphone, tablet, and even your smartwatch, allowing you to budget from anywhere. You can sign up for a free trial on YNAB’s website. The app will ask you a few questions about your expenses, debt, and savings goals to set up an account tailored to your finances. Then you can further customize your budget from there. After the free trial period, YNAB costs $14.99 per month or $109 per year if you pay annually. This puts it on the expensive side of the best budgeting apps.

You can get YNAB here.

4. Quicken – Simplifi

Another notable mention in this list of best budgeting apps is Quicken Simplifi. Quicken Simplifi automatically creates a budget for you based on your income, recurring bills, savings goals, and planned spending. Your spending plan will adjust throughout the month based on your transactions, which the app reconciles and categorizes for you. At a glance, you’ll be able to view how much money you can spend during the rest of the month based on your purchases and savings targets.

The app also has in-depth financial reporting. You can track your spending patterns over time and filter transactions by payee or tags you create. There’s also an investment portfolio page that shows the value of your current holdings, investment gains and losses over time, and news updates related to your assets. Users appreciate the tax planner, which allows you to keep track of your refunds and view your projected tax liability.

Getting Started

Quicken Simplifi has both a web and mobile app, but no free version. The subscription costs $5.99 per month when billed annually. However, Quicken reportedly runs frequent sales, so you may be able to score a discount. It’s worth noting that Quicken Simplifi can be difficult to set up properly. One of the main complaints from reviewers is issues linking bank accounts and credit cards. Luckily Quicken offers a 30-day money-back guarantee so you can try it risk-free.

The link to Quicken Simplifi’s website is here.

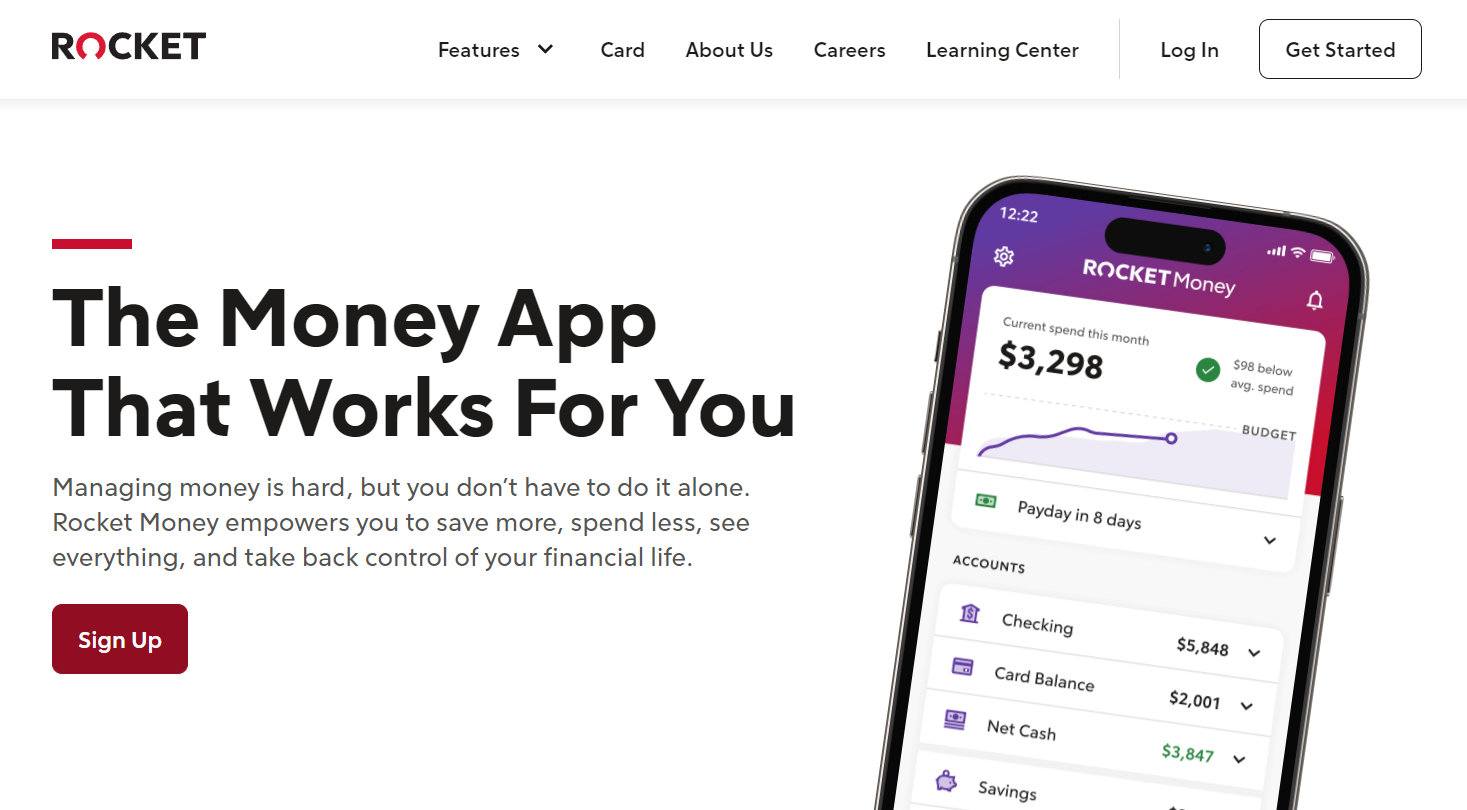

5. Rocketmoney

Rocket Money analyzes your spending history and automatically creates a budget for you. Plus, the app will categorize your transactions for you and alert you if you come close to exceeding any of your budget categories. You’ll also receive notifications about upcoming charges and low balances in your accounts, which helps prevent overdrafting. Rocket Money can even determine the best time of the month to set aside savings based on your cash flow. If you set up a savings account with Rocket Money, you can take advantage of the auto-savings feature, which deposits money into savings on your behalf.

Like other top budgeting apps, Rocket Money provides spending reports and insights to help you optimize your finances. You can also view your credit score and link investment accounts to track your net worth right in the app. There’s even a bill negotiation service that saves you money on car insurance, cable, subscriptions, and more. However, you’ll be charged a percentage of the first year’s savings as a fee, which reduces the financial benefit of the program.

Getting Started

Although Rocket Money has a free version, it doesn’t allow you to access certain features, such as net worth tracking and custom budget categories. So you may need to upgrade to the premium subscription, which has a pay-what-you-can pricing model. Subscribers can choose a fee of anywhere from $6 to $12 per month based on their financial means. There’s also a 7-day free trial, allowing you to test the waters. Rocket Money has both a desktop and mobile version, allowing you to budget on the go.

Rocket Money’s website is here.

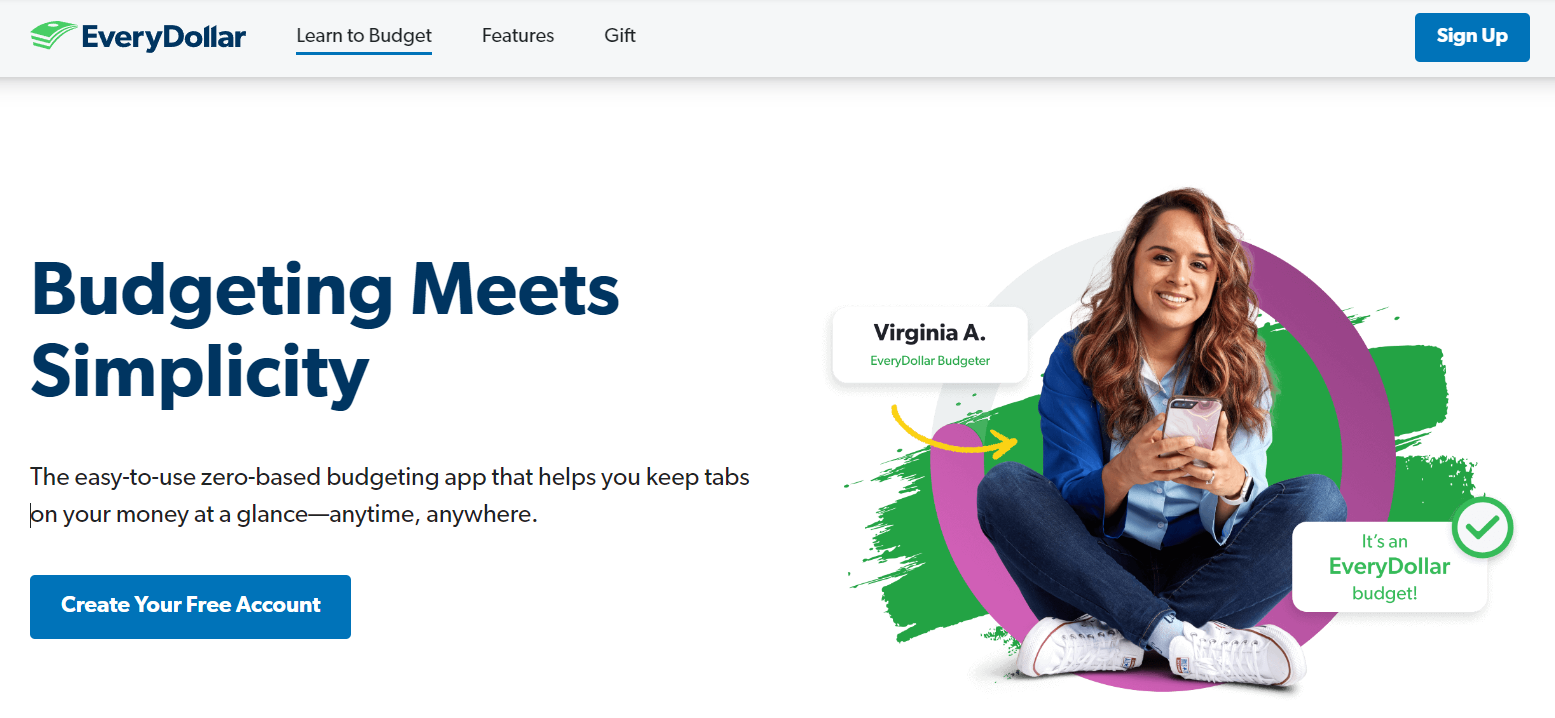

6. EveryDollar

EveryDollar was created by financial guru Dave Ramsey and utilizes the zero-based budgeting method, making it similar to YNAB. In the budget tab of the app, you can forecast your expected income, planned spending amounts, and savings targets. Throughout the month, EveryDollar will keep a running tally of your actual spending totals and remaining funds.

Users with a free plan must manually input their transactions, whereas premium subscribers can connect their bank account for automatic syncing. EveryDollar also has an insights section with graphs and charts that break down your spending patterns and income fluctuations over time. This feature enables you to easily see how well you’re sticking to your budget and identify areas for improvement. Premium subscribers can also set financial goals within the app, tracking their progress and net worth along the way. Plus, they get access to a paycheck planning feature to help them manage their cash flow throughout the month as bills come due.

Getting Started

EveryDollar has a web version and a mobile app if you’d prefer to budget on your phone. To get started, simply create an account and answer a few questions about your goals and finances. You’ll also be asked if you want a free or premium subscription, which costs $17.99 per month or $79.99 per year. EveryDollar offers a free trial, allowing you to test out the premium features before committing. If you have questions during setup, you can visit the help center or call the support hotline.

You can find EveryDollar here.

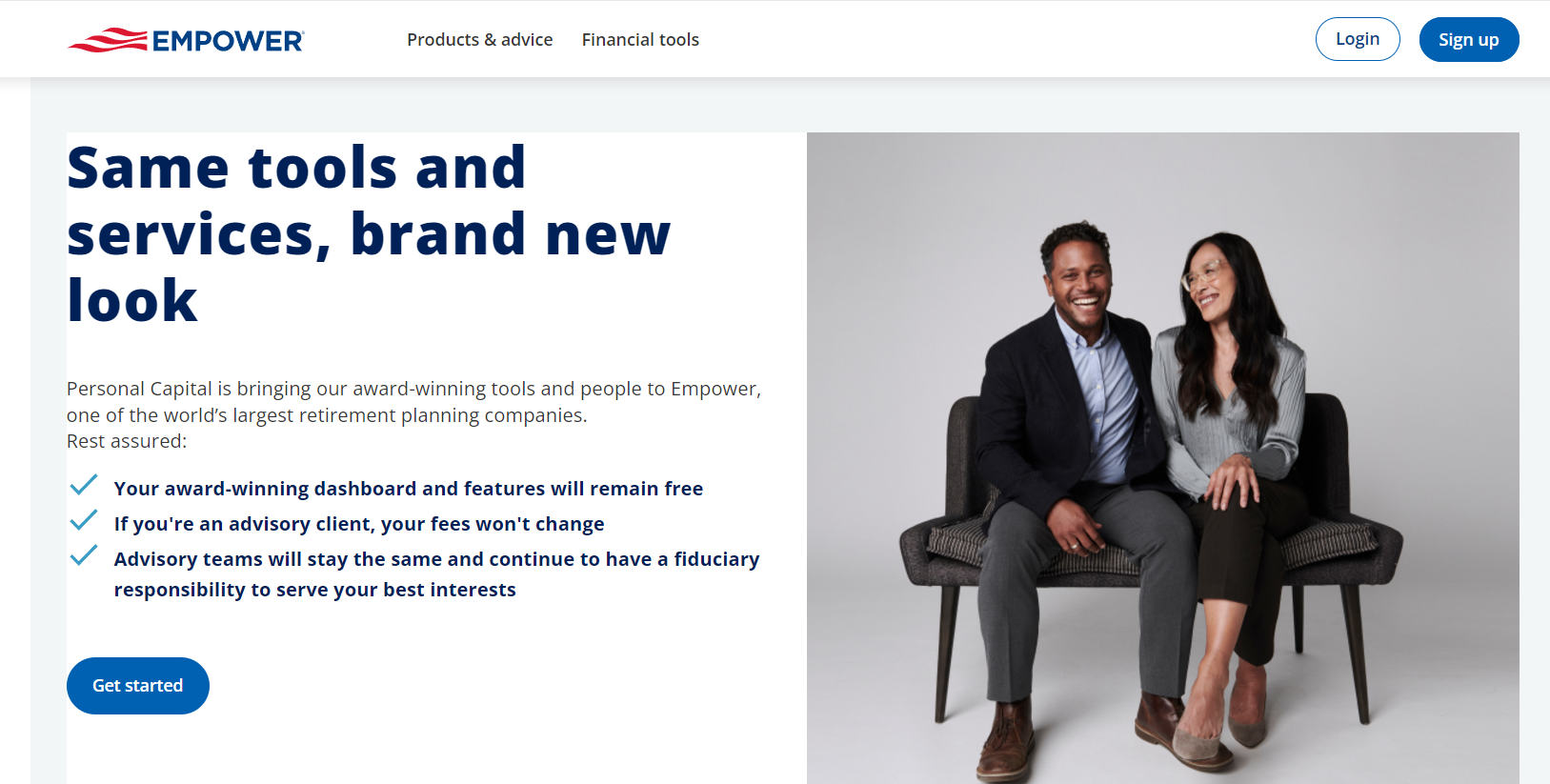

7. Empower Personal Dashboard (Personal Capital)

Empower Personal Dashboard is the best budgeting app for retirement planning. The software allows you to track your net worth and investments, including alternative assets like artwork and gold. Empower also displays your portfolio’s performance over time and analyzes your asset allocation to help you diversify your holdings. Plus, the app can estimate whether or not you’re on track to hit your retirement goals. It considers factors like the value of your investments, your household composition, location, projected Social Security income, and more.

You can even test different annual savings rates to see how they’ll affect your progress. Empower also offers a savings planner to help you set concrete goals and build an emergency fund. Last but not least, the budgeting tool automatically tracks your transactions and breaks down your top spending categories to identify potential money leaks.

Getting Started

Empower is completely free and easy to use and works on both mobile and desktop. Keep in mind that some features are not available on the mobile app, such as the investment performance tracker. Additionally, Empower may try to upsell their premium wealth management service to certain users.

You access Empower here.

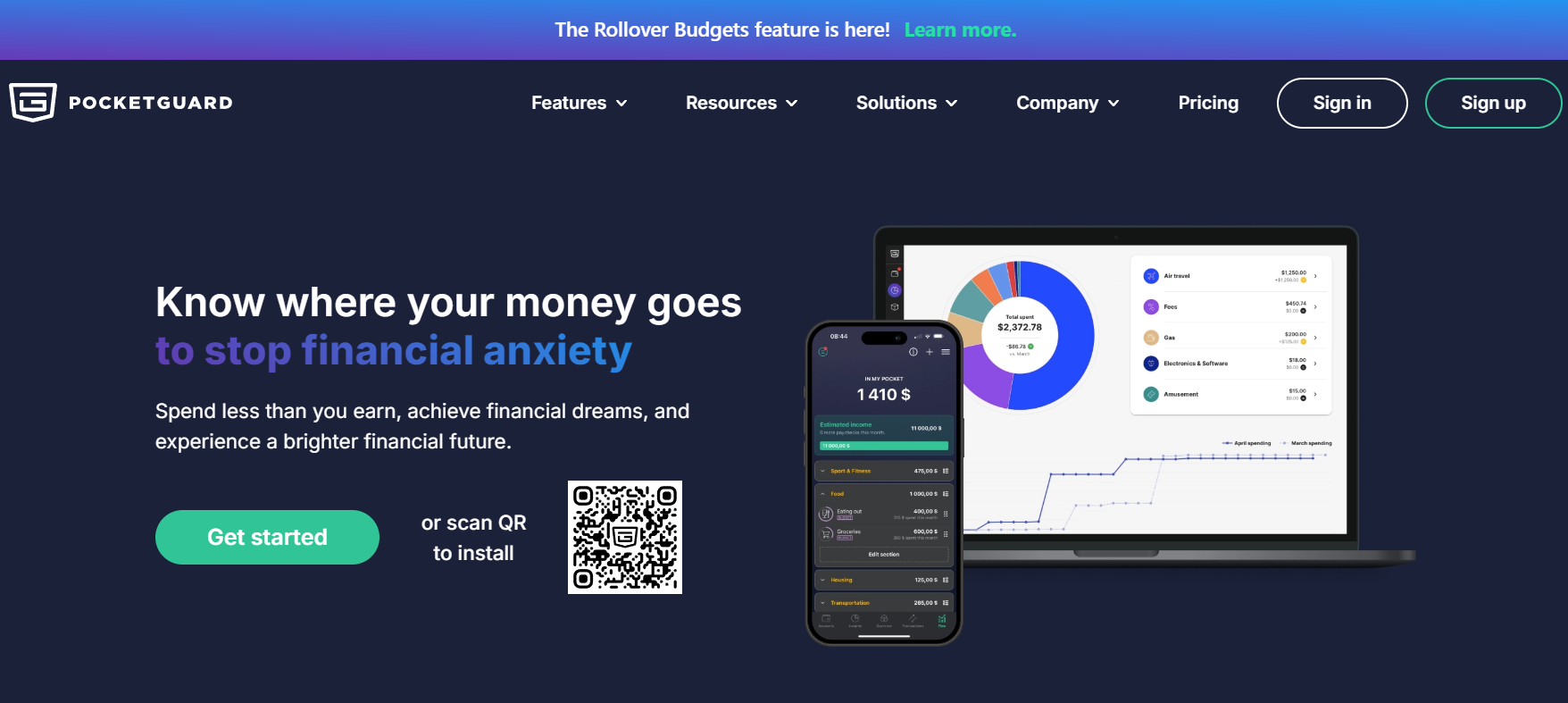

8. Pocketguard

PocketGuard is easy to use and customizable, allowing you to create 70 or more budget categories if needed. When you use up 50% or more of your budget in a certain category, you’ll get an alert to prevent overspending. PocketGuard also helps you plan for annual expenses in advance by scheduling them to recur on a yearly basis. You can even set SMART savings goals and get notified when you aren’t setting aside enough money to reach them.

If you have debt, you can create a debt payoff plan using either the snowball or avalanche method. PocketGuard will generate a payoff schedule based on your debt balances and available funds after living expenses. You can even adjust this plan and play around with different scenarios to see how your spending choices affect your debt-free date. Additionally, PocketGuard has personal finance courses, a subscription canceling feature, a bill negotiation service, and analytics tools to help you manage your cash flow.

Getting Started

PocketGuard has both a web and mobile version and offers a 7-day free trial so you can test it out. If you decide to become a paying subscriber, you’ll be charged $74.99 annually or $12.99 per month. It’s also worth noting that the bill negotiation service takes a cut of your savings as a fee.

To navigate to PocketGuard’s website go here.

9. Honeydue

Honeydue is a great solution for couples who split expenses and have multiple accounts to manage. You can link your loans, bank accounts, credit cards, and investment platforms to view your full financial picture all in one place. Couples who haven’t fully combined their finances can choose what to share with their partner. If there are certain transactions or accounts you’d rather keep separate, you can hide them to maintain your privacy.

Honeydue makes household budgeting easy by allowing you to set spending limits for each category. You and your partner will receive alerts when you’re close to exceeding your budget. The app automatically tracks and categorizes your spending, even indicating which partner made each purchase. If you owe your partner money for takeout or other everyday expenses, you can settle the balance right in the app. The main downside is the lack of technical support. Some reviewers were frustrated that the app was buggy and no one was available to help troubleshoot.

Getting Started

Honeydue is completely free to use. Simply download the mobile app, personalize your profile, and invite your partner to get started. Keep in mind that there’s no web interface, so you and your significant other will both need a mobile phone.

Honeydue can be found at the Apple app store.

10. Greenlight

Greenlight is one of the best budgeting apps for children and parents. Paired with the accompanying debit card, Greenlight teaches kids how to save and spend responsibly. From the app, guardians can set spending limits and block unsafe transactions to establish guardrails. Greenlight also allows kids to request and receive funds from their parents as needed. Plus, parents can assign chores and automatically send the payment to their child’s debit card.

Kids can use the app to set savings goals and earn interest on their funds. They can also play fun financial games to learn more about how money works. Premium Greenlight plans come with additional safety features, such as location tracking, SOS alerts, and driving reports. There’s also an investing feature to help your child learn the power of compound interest. With your permission and guidance, they can trade stocks to get a head start on building wealth.

Getting Started

Greenlight’s most basic plan costs $4.99 per month and includes debit cards for up to five children. However, if you want your kids to be able to earn cash back on their purchases and begin investing, you’ll need to upgrade to the Max Plan for $9.98 per month. To access the teen driving reports and safety features, you must subscribe to the highest Infinity tier for $14.98 per month.

Greenlight can be found on the company’s webpage.

11. WallyGPT

WallyGPT is one of the best personal finance apps powered by AI, allowing you to manage your finances with ease. Wally can automatically track your income, spending, and upcoming bills, even reminding you of due dates to help you avoid late fees. It can also calculate your net worth to keep you updated on your financial progress. You can even ask Wally questions about your finances and receive detailed, accurate answers. For example, Wally can help you create a personalized savings plan for a big upcoming purchase, such as buying a home or car.

You can also ask Wally to explain trends and changes in your spending to help you understand and modify your financial behavior. The app is even capable of breaking down complex financial topics like sequence of returns risk into simple terms anyone can understand. Although Wally boasts some impressive features, it gets a low rating overall. Wally received 1.7 stars on the Google App Store and 1 star in the Apple Store. Some users reported tech issues and bugginess that prevented the app from working correctly.

Getting Started

WallyGPT has both a desktop version and a mobile app. It has wide compatibility, linking with over 15,000 financial accounts in 70 countries. You can take advantage of the free version to level up your finances without having to make room for another subscription in your budget. However, you’ll be limited to about 50 questions per day. So if you anticipate needing more support than that, consider upgrading to one of Wally’s paid subscription plans.

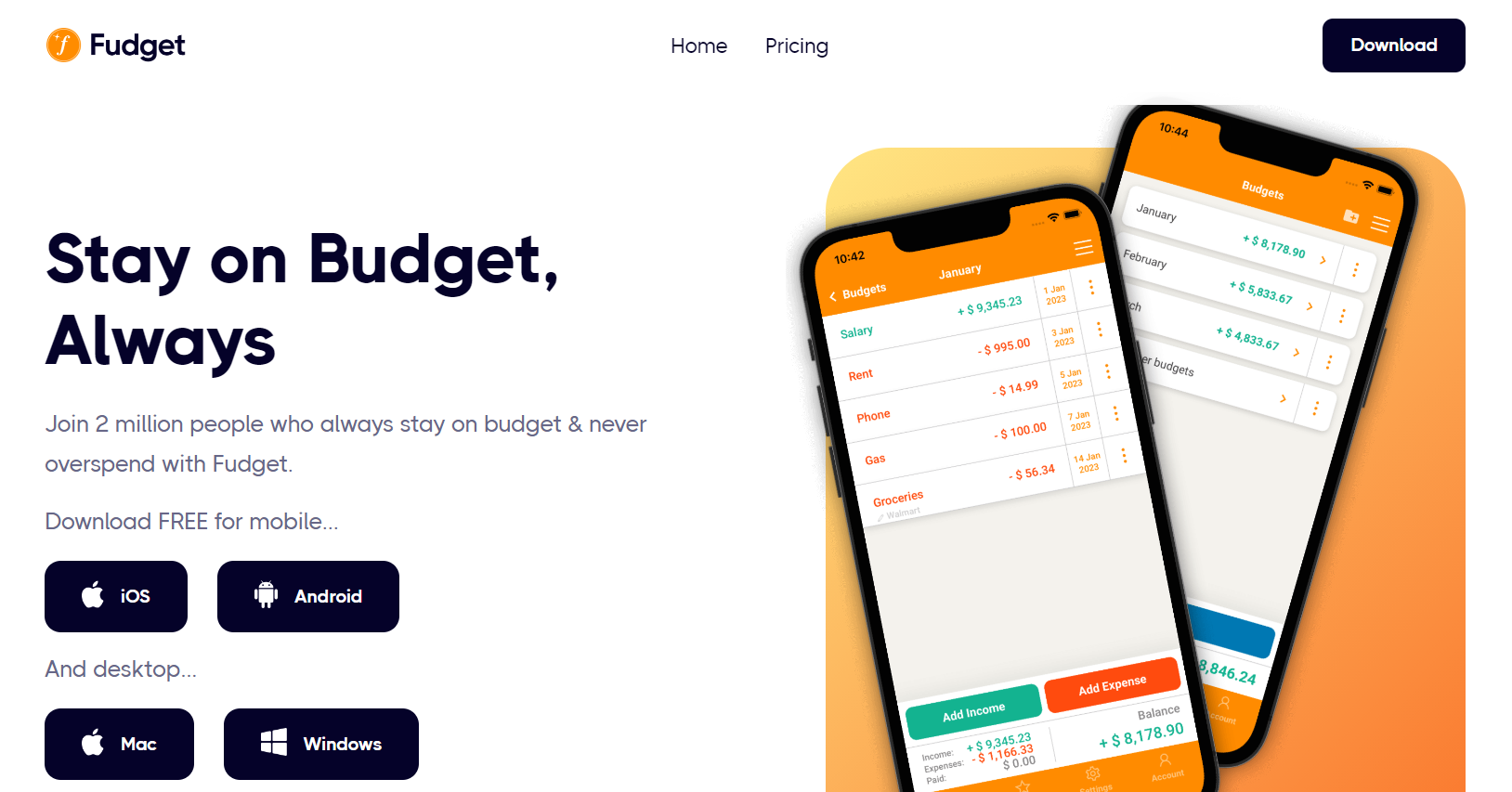

12. Fudget

Fudget is a simple budgeting app that doesn’t sync with your bank accounts or automatically track your transactions. You’ll have to input each of your purchases individually, just like you would on paper or in Excel. This can help you be more mindful of your purchases and reflect on your spending. Fudget allows you to carry over recurring income and expenses from month to month, so you won’t have to waste time reentering your fixed bills constantly.

The app also enables you to add notes to your transactions, easily search and filter through your entries, and visualize your spending through charts. There’s even a calculator and running tally of your purchases to help you avoid overspending. Due to its pleasant user experience, Fudget received a high rating of 4.7 stars with over 600 reviews. But the lack of automatic expense tracking could wreak havoc on your finances if you slack on entering your purchases or “fudge” your spending.

Getting Started

Fudget works on IOS, Android, Windows, and Mac. The basic version gives you 5 different budgets and 250 entries for free. If you need more entries, you can upgrade to the premium version for $19.99 annually. Not ready to commit to a full year? You can take advantage of the 7-day free trial or opt for the six-month plan instead, which costs $14.99.

You can download the app for Android or Iphone on their website.

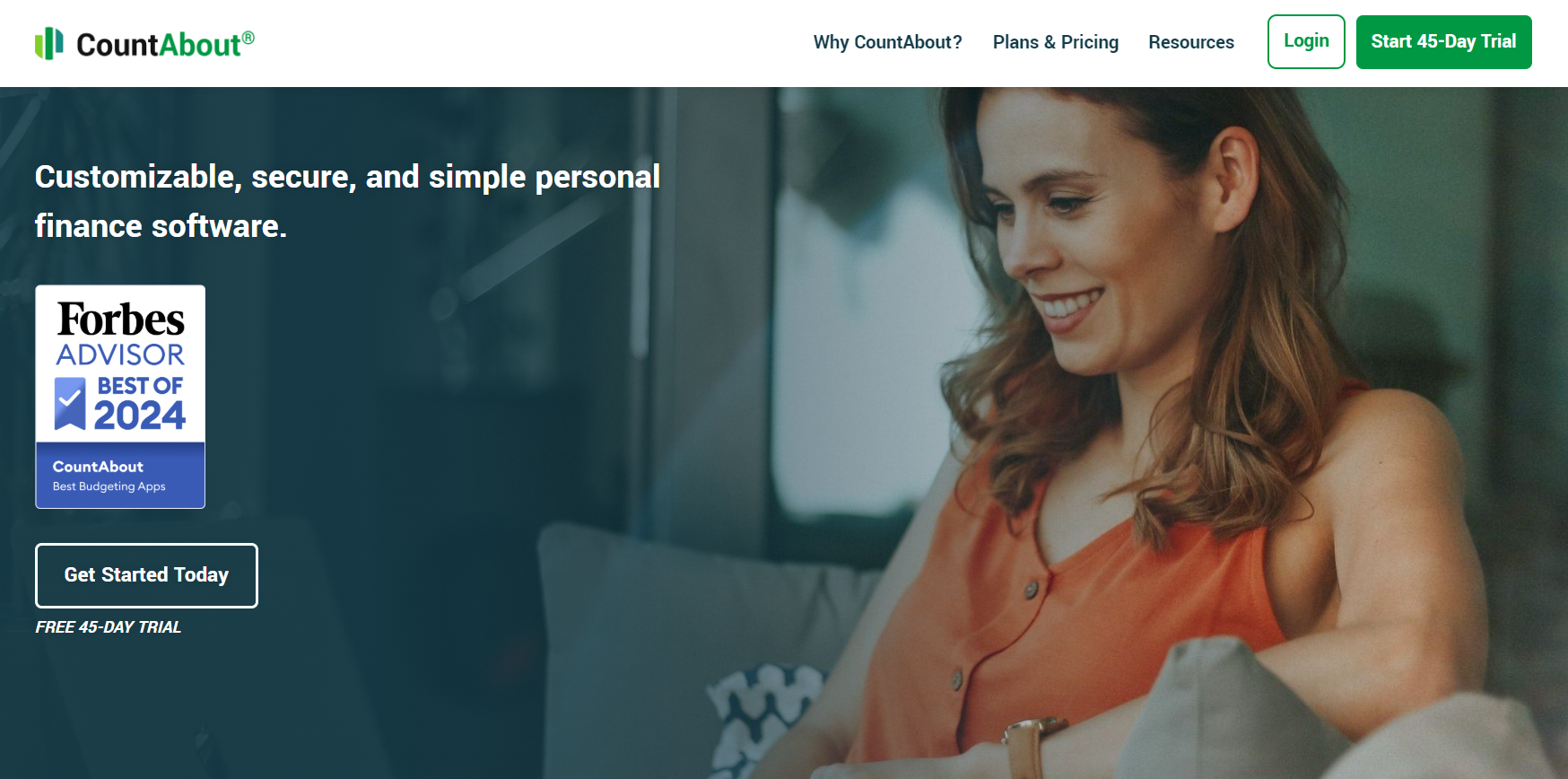

13. Countabout

CountAbout is one of the best budgeting apps for solopreneurs, allowing you to manage your company’s finances and your own in one place. For an extra fee, you can send invoices to customers and upload receipts to track your business expenses. You can also create a bill payment schedule to help manage your cash flow.

The premium version of the app automatically downloads data from your bank accounts, credit cards, and investment accounts. However, it doesn’t categorize transactions for you, so you’ll have to manually reconcile them. Users can create as many budget categories as they want and split transactions as needed. There’s also a useful savings projection tool that shows you how small spending reductions can speed up your financial progress.

Getting Started

CountAbout has a web version and a mobile app. You can try the software risk-free for 45 days to make sure it’s a good fit. The basic plan costs $9.99 per year, billed annually. If you want automatic bank syncing, you’ll need to upgrade to the premium plan for $39.99 per year. Invoicing costs an additional $60 per year, and the ability to upload receipts to transactions costs $10 per year.

CountAbout can be accessed at the apps webpage.

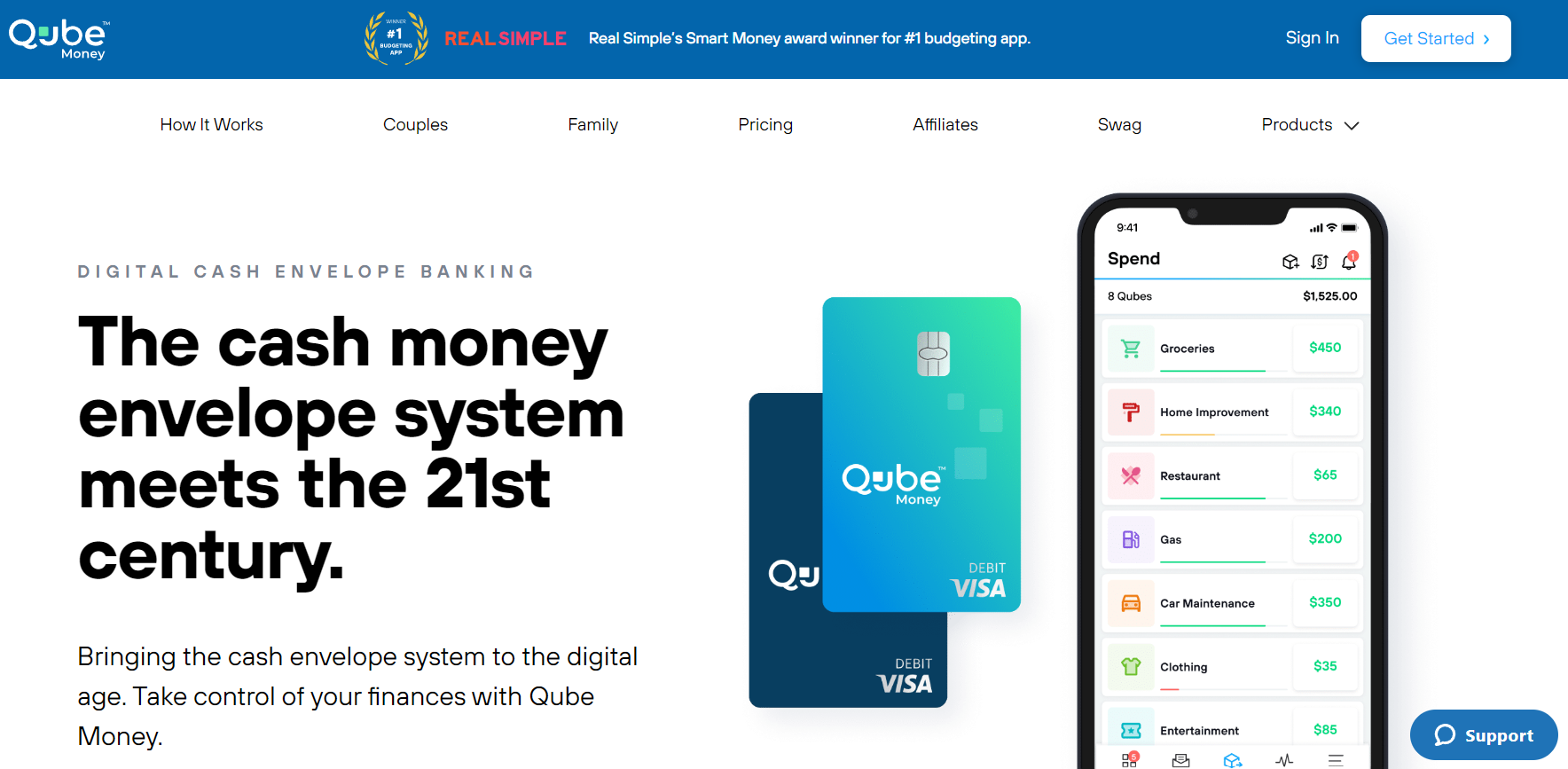

14. Qube Money

Qube Money aims to provide a more regimented budgeting system complete with an app, bank account, and debit card. The app utilizes the envelope budgeting method to help you plan your spending in advance. You’ll create envelopes called “qubes” for each of your bills, discretionary spending categories, and savings goals. Then you’ll fund these envelopes using the cash in your Qube bank account. If needed, you can transfer money between qubes at any time. Qube’s proactive spending feature helps ensure you stick to the plan you create. The linked debit card maintains a $0 balance until you select which envelope to spend from.

Qube’s premium plan also allows you to add a companion to your account. Your companion will receive their own debit card so they can spend from the joint bank account and shared qubes. The premium subscription also allows you to create unlimited qubes, schedule recurring transfers, and set up a plan to fund your qubes automatically every month. If you want to add more than one companion to your account, you can sign up for Qube’s family plan. It allows you to give debit cards to up to five people in your household.

Getting Started

After creating your account, you can choose the level of features you need. While there is a free option, access to premium features such as subscription management and the ability to add a companion can be unlocked for $12 per month. If you have a larger household, consider upgrading to the family plan for $19 per month. Keep in mind that each card holder will need a smartphone with the Qube app to select the appropriate envelope and load their debit card. The Qube app works with Apple and Android.

QubeMoney can be found here.

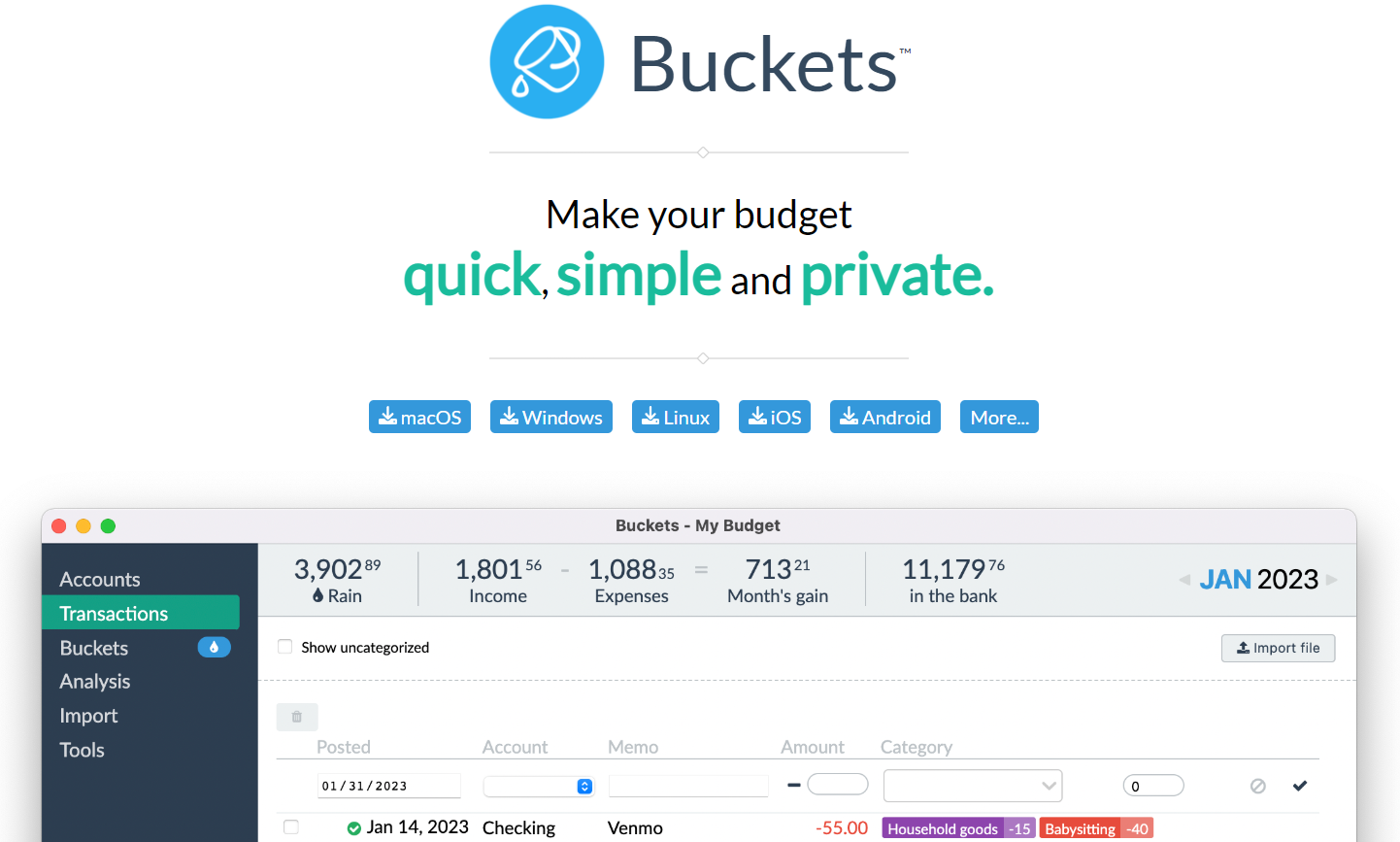

15. Buckets

Billed as a “Private Family Budgeting App”, Buckets is one of the best budgeting apps for the envelope method. It allows you to set aside money in various “buckets” for recurring bills, discretionary spending, savings goals, and debt repayments. As you spend throughout the month, you’ll manually enter your transactions or upload your bank statements. Then you’ll reconcile each transaction by indicating which “bucket” the purchase is associated with. Keep in mind that Buckets doesn’t automatically sync with your bank unless you sign up for SimpleFIN Bridge, which costs extra.

Getting Started

Buckets has a very flexible free trial that they advertise as having no time limit. When you’re ready to buy the software, you’ll only owe a one-time payment of $64. The software is designed for local computer use for increased data privacy. It’s compatible with Macs, PCs, and Linux machines. There’s also a mobile app that allows you to input your purchases on the go, which can be synced with your computer software for real-time tracking.

Buckets can be found at budgetwithbuckets.com.

16. Tiller

One of the best budgeting apps for Excel lovers is Tiller, which connects your bank accounts to your spreadsheets. Tiller automatically transfers your financial data to Excel or Google Sheets, allowing you to easily track your transactions, income, debt, and savings balances. Tiller categorizes your purchases for you based on rules you set and comes with custom templates to help you personalize your spreadsheet. You’ll also receive a daily email that summarizes your recent transactions and balances, giving you an updated picture of your finances.

Tiller is completely ad-free and has a collaboration feature that allows you to share your budget with a partner in real-time. There’s a library of help guides, a customer care team, and a peer community to support you if needed.

Getting Started

Tiller can be integrated with Google Sheets or Microsoft Excel depending on your preference. You can access your budget spreadsheet via your desktop or the mobile app version of Excel or Google Sheets. Tiller has a 30-day free trial and charges $79 per year thereafter.

Tiller can be found here.

17. Goodbudget

Last in the list of the best budgeting apps, Goodbudget is home budgeting software based on the envelope budget system. The main idea is you use the software to make digital “envelopes” for all your budgeting categories – housing, food, automotive, insurance, etc. Then you use the app to allocate an amount of money up front for each envelope. This allows you to plan your spending, not just track it. Planned spending is usually a good idea, especially for large savings or debt reduction goals.

While Goodbudget is well reviewed (4.6 stars out of 5 in the App Store), the app is high maintenance. It doesn’t automatically update your bank account and handle transactions for you. But, data categorization and some other features are semi automated. The software does have features that lets two people synchronize budgets, making the app good for couples. It is available on the web, or on Android or iPhones.

Getting Started

Getting Goodbudget is pretty easy. You just need a money, a bank account and a valid working email. The software has a free and a paid Plus plan at $10 per month or $120 per year.

You can find them here.

Frequently Asked Questions

Are budget apps worth it?

You probably want to create and stick to a budget to save money. So it may seem counterintuitive to pay for budgeting software and add another subscription to your monthly expenses. However, many people find that they actually come out ahead, saving more money than the app costs. For example, You Need a Budget says that new users save an average of $600 in their first two months, which more than covers the $109 annual fee.

According to an Intuit survey, more than 60% of respondents didn’t know how much they spent in the previous month. The best budgeting apps sync with your bank account and credit cards to automatically track and categorize your transactions. They also have handy charts and graphs that can help you understand your spending at a glance, enabling you to stay on top of your finances. Although it’s possible to manage your money with just an Excel sheet, the additional time-saving features make the best budgeting apps worth the cost.

What is the best alternative to Mint?

Still grieving the loss of Mint? Many people loved the app’s streamlined interface, which showed them their whole financial picture in one place, from investments to average monthly spending. Lunch Money is one of the best budget apps for former Mint users due to its pleasing design, ease of use, and comprehensive financial tracking. Lunch Money automatically syncs with all of your important financial accounts, allowing you to keep tabs on your spending, investments, and bank account balances. You can even monitor your crypto holdings and outstanding debt all from the same app, giving you a bird’s eye view of your finances.

What’s the best budgeting app to help with finances?

The best budgeting app for you depends on your financial needs and money management style. If you and your partner are trying to get on the same page about money, apps designed for couples like Honeydue and Monarch Money may work for you. For individuals who want to keep tight control over their spending, zero-based budgeting apps like YNAB and EveryDollar are worth considering. They help you decide how to spend each dollar you earn in advance, helping you create a strict game plan for your money. People who prefer a flexible app that works with any budgeting style will enjoy Lunch Money, our top pick.

What is the best budgeting method?

One of the best budgeting methods to help you reign in your spending is the 50/30/20 rule. It involves setting aside 50% of your income for needs like housing, food, and utilities. Roughly 30% of your income can be allocated toward wants like vacations and hobby purchases. The remaining 20% of your salary should be funneled into savings and investments. If needed, you can adjust these percentages to suit your unique financial situation. For example, if you have outstanding student loans, you might consider reducing your entertainment spending to clear your debt faster.

The Bottom Line

Most of us don’t have enough time to meticulously comb through our bank statements and figure out exactly what we’re spending. Many of the best budgeting apps will automatically track and categorize your transactions to make it easier to manage your money. Even if the budgeting software you choose is pay-to-play, it will likely save you more than it costs by giving you better financial clarity and control.

Author’s Contact Information:

Vicki Munroe

Email: [email protected]

James Hendrickson

Email: [email protected]

Phone: (202) 468-6043

Material Connection Disclosure: Some of the links in this article are “affiliate links.” If you click on the link and make a purchase or sign-up, Saving Advice will receive an affiliate commission – which will help keep the site going. We only recommend products we think will add value to savingadvice.com readers. We are disclosing this in compliance with Federal Trade Commission’s 16 CFR, Part 255: “Guides Concerning the Use of Endorsements and Testimonials in Advertising.”

Read the full article here