For those who are looking for investing advice, it pays to find someone who can be a financial mentor. That is, someone whose advice you trust, and who has a track record of doing well. When it comes to investing advice, there are very few people that get more respect than Warren Buffett. This is for good reason. He has consistently given sound financial advice that has helped numerous people increase their net worth over the years. With this in mind, it makes sense to, at the very least, consider the investing advice that comes out of his mouth.

Whenever the Berkshire Hathaway annual report goes public, it’s read over by financial analysts with a fine toothed comb. It makes sense. Many of those reading the report hope they can find some insight that can give them an edge in their own investing. The funny thing is, you don’t have to look very hard to find the investing advice that Buffett believes most people should follow. This is because he puts it out there for everyone to see as bright as day.

Buffett’s Advice: Buy Index Funds and Short Term Government Bonds

In 2013 Warren Buffett famously wrote that he has given instructions to his wife on what she should do with the money she inherits when he dies (here). One might think that the instruction might get quite complicated since she’ll be inheriting money from one of the richest men in the world.

The truth is that the advice is actually quite simple. Warren Buffet wants his wife to invest 90% of her inheritance into a low-cost S&P 500 index tracker. He also advised that she should invest the remaining 10% into short-term government bonds. That’s it. Nothing fancy, but still sound financial advice.

He writes:

Studies have repeatedly demonstrated that few fund managers are able to outperform the S&P 500 over extended periods of time (Morningstar, Dow Jones/Spiva, NBER). With the knowledge that most active fund managers will return less money than an S&P 500 index fund while charging more in fees, the advice is really nothing more than common sense. This is the way that Buffett believes most people should invest. It’s how one of the best investors in the world wants his own wife to invest when he’s gone.

The problem for many with this advice is that it’s rather boring. There isn’t much excitement day to day when 90% of your money is in index funds with the other 10% in government bonds. It lacks any type of sexiness, at least in the short term.

An additional problem with index funds is they give you market performance, but ONLY market performance. This means index fund holders will have returns that track the market, no worse, but also no better. So, with index funds, investors will never get a chance to beat the market.

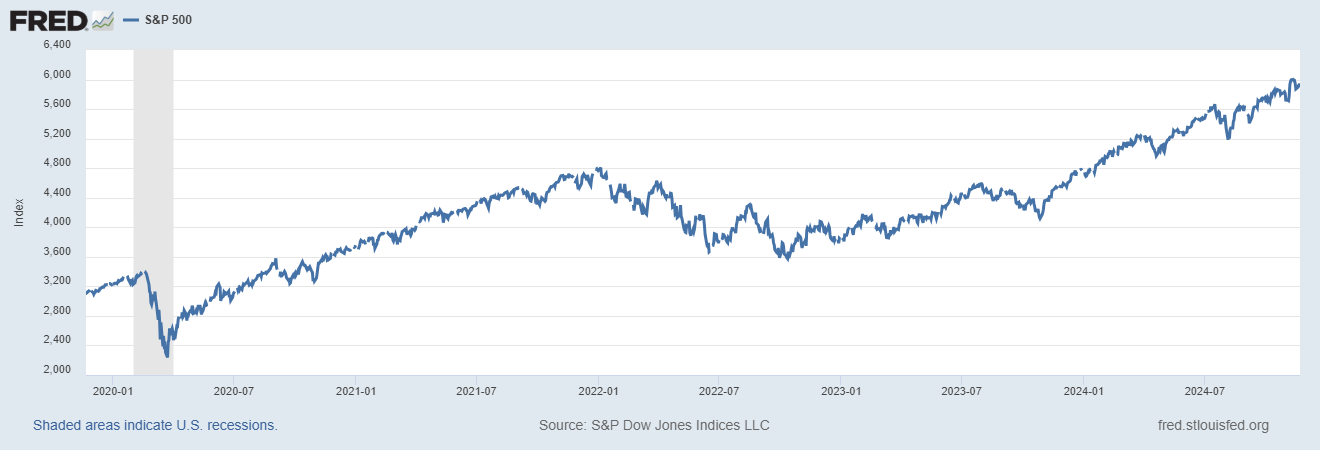

And in some years, the index has actually lost money. For example, here is the performance of the S&P 500 as charted by the St. Louis Federal Reserve. It shows that during 2022, the S&P actually took a loss of around 20 percent. In that year, investors would have been better off holding corporate or government bonds.

Does Buffett Practice What He Preaches?

No. He doesn’t.

The reality is that Buffett’s trading behavior and his public pronouncements don’t always match. While Buffett openly preaches buy and hold, his trading behavior has been far more diverse. During his early career, Buffett used arbitrage techniques, short-term trading, liquidations, rather than investing in index funds or using the buy and hold techniques that he became famous for with companies like Coca-Cola. In the latter stages of his career he was able to diversify his portfolio using fixed income arbitrage, currencies, commodity plays, and other techniques.

If you want more details on this, get a copy of James Altucher’s book: Trade Like  Warren Buffett

Warren Buffett. The book walks you through the strategies that Warren Buffett uses to make money trading the equity and debt markets. Altucher’s book is probably also the most accurate and comprehensive work on Buffett’s trading career that you are likely to find anywhere. You should definitely give it a thorough read if you are serious about understanding how Buffett really made money.

Second, Buffett definitely didn’t get rich from following his own boring advice. Most of his career has been wrapped up in buying and owning cash rich companies – not holding index fund shares. If you want a detailed blueprint on how he did it, consider getting a copy of The Snowball: Warren Buffett and the Business of Life. It is an authoritative and comprehensive review of Buffett’s career – loaded with lessons for the average investor. Both books work well together to give you an excellent overview of what Buffett did to make his business successful.

Related Articles

Warren Buffet And His Boring Investing Advice Will Make You Rich

Fifteen Inspiring Warren Buffet Investing Quotes

Is 10% A Good Return? What’s a Good Return? Or A Bad Return?

Read the full article here